WeightWatchers 2013 Annual Report Download - page 57

Download and view the complete annual report

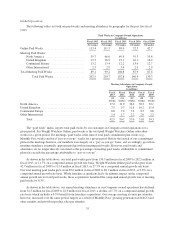

Please find page 57 of the 2013 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Franchise Rights Acquired, Goodwill and Other Intangible Assets

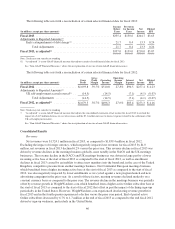

Finite-lived intangible assets are amortized using the straight-line method over their estimated useful lives

of 3 to 20 years. We review goodwill and other indefinite-lived intangible assets, including franchise rights

acquired, for potential impairment on at least an annual basis or more often if events so require. We performed

fair value impairment testing as of the end of fiscal 2013 and fiscal 2012 on our goodwill and other indefinite-

lived intangible assets.

In performing the impairment analysis for goodwill, the fair value for our reporting units is estimated using

a discounted cash flow approach. This approach involves projecting future cash flows attributable to the

reporting unit and discounting those estimated cash flows using an appropriate discount rate. The estimated fair

value is then compared to the carrying value of the reporting unit. We have determined the appropriate reporting

unit for purposes of assessing annual impairment to be the country for all reporting units aside from

WeightWatchers.com, for which the reporting unit has been aggregated into one unit. The values of goodwill for

the WWI reporting units in the United States, Canada and other countries at December 28, 2013 were $32.7

million, $5.1 million and $3.7 million, respectively, totaling $41.5 million. The value of goodwill for the

WeightWatchers.com reporting unit at December 28, 2013 was $37.8 million.

In performing the impairment analysis for franchise rights acquired, the fair value for our franchise rights

acquired is estimated using a discounted cash flow approach referred to as the hypothetical start-up approach.

The estimated fair value is then compared to the carrying value of the unit of accounting for those franchise

rights. We have determined the appropriate unit of account for purposes of assessing annual impairment to be the

country in which the acquisitions have occurred. The values of these franchise rights in the United States,

Canada, United Kingdom, Australia/New Zealand and other countries at December 28, 2013 were $697.3

million, $110.4 million, $14.4 million, $13.7 million and $1.0 million, respectively, totaling $836.8 million.

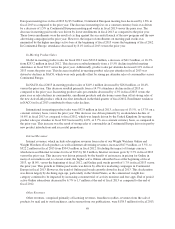

When determining fair value, we utilize various assumptions, including projections of future cash flows,

growth rates and discount rates. A change in these underlying assumptions will cause a change in the results of

the tests and, as such, could cause fair value to be less than the carrying amounts. In the event such a decrease

occurred, we would be required to record a corresponding charge, which would impact earnings. We would also

be required to reduce the carrying amounts of the related assets on our balance sheet. We continue to evaluate

these estimates and assumptions and believe that these assumptions are appropriate.

In performing the impairment analysis for the fiscal year ended December 28, 2013, we determined that,

based on the fair values calculated, the carrying amounts of the franchise rights acquired related to our Mexico

and Hong Kong operations exceeded their respective fair values as of the end of fiscal 2013 and recorded

impairment charges of $935 and $231, respectively. We determined that the carrying amounts of our other

remaining assets did not exceed their respective fair values, and therefore, no other impairment existed.

We estimate future cash flows for each unit of accounting by utilizing the historical cash flows attributable

to the rights in that country and then applying a growth rate using a blend of the historical operating income

growth rates for such country and expected future operating income growth rates for such country. We utilize

operating income as the basis for measuring our potential growth because we believe it is the best indicator of the

performance of our business. For fiscal 2013, the compound annual growth rates used in our discounted cash

flow analysis ranged from a decline of approximately 5% to growth of approximately 12%. In applying the

hypothetical start-up approach in fiscal 2013, we generally assume the year of maturity is reached after 7 years.

Subsequent to the year of maturity we have assumed growth rates ranging from a decline of approximately 2% to

growth of approximately 8%. For fiscal 2012, the blended growth rates used in our discounted cash flow analysis

ranged from a decline of approximately 3% to growth of approximately 50%. We then discount the estimated

future cash flows utilizing a discount rate which is calculated using the average cost of capital, which includes

the cost of equity and the cost of debt. The cost of equity is determined by combining a risk-free rate of return

and a market risk premium. The risk-free rate of return is generally determined based on the average rate of long-

43