WeightWatchers 2013 Annual Report Download - page 48

Download and view the complete annual report

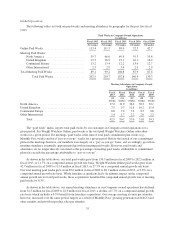

Please find page 48 of the 2013 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Online paid weeks growth throughout that year, this subscriber base was higher at the beginning of

fiscal 2013 than at the beginning of fiscal 2012. In fiscal 2013, the Online paid weeks growth

deceleration continued throughout the year driven by declining sign-ups in the US business. By the end

of the first half of fiscal 2013, this decline in sign-ups led to our active Online subscriber base dropping

below the prior year period. This negative sign-up trend continued in the second half of fiscal 2013

driven primarily by the US business, as the commercial weight loss category continued to be impacted

by increasing consumer trial of activity monitors and free apps.

•In-meeting product sales. Global product sales were down 4.2% on a compound annual growth rate

from fiscal 2009 through fiscal 2013. Our average product sales per attendee in our meetings business

grew from $4.63 to $4.94 at a compound annual growth rate of 1.6% during that period as a result of

successful new product and program launches. However, we experienced a decline in the number of

members attending meetings which drove a decline in our global product sales during that period.

•Licensing revenues. Licensing revenues declined at a compound annual growth rate of 0.2% from fiscal

2009 through fiscal 2013. Despite our increased focus on expanding the number of Weight Watchers

branded and endorsed products worldwide, the decrease in consumer confidence and discretionary

spending from the global economic downturn negatively impacted this revenue category during that

period. In addition, during fiscal 2012 and fiscal 2013, the licensing business was further negatively

impacted by competition from lower priced store branded products.

Metrics and Business Trends

Performance Indicators and Market Trends

Our management reviews and analyzes several key performance indicators in order to manage our business

and assess the quality and potential variability of our cash flows and earnings. These key performance indicators

include:

• net revenues;

• paid weeks and attendance metrics;

• meeting fees per paid week and in-meeting product sales per attendee;

• the number of end of period Monthly Pass active subscribers and active Online subscribers; and

• gross profit and operating expenses as a percentage of revenue.

We believe that our revenues and profitability can be sensitive to major trends in the weight management

industry. In particular, we believe that our business could be adversely impacted by:

• increased competition from Internet, free mobile and other weight management applications, activity

monitors and other electronic weight management approaches;

• the development of more favorably perceived or more effective weight management methods,

including pharmaceuticals;

• a failure to develop innovative new services and products or to successfully expand into new channels

of distribution;

• a failure to successfully implement new strategic initiatives;

• a decrease in the effectiveness of our marketing and advertising programs;

• an impairment of the Weight Watchers brand and our other intellectual property;

• a failure of our technology or systems to perform as designed; and

• a downturn in general economic conditions or consumer confidence.

34