WeightWatchers 2013 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2013 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

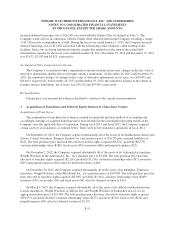

The weighted-average grant-date fair value of all options granted was $11.37, $16.60 and $20.44 for the

years ended December 28, 2013, December 29, 2012 and December 31, 2011, respectively. The total intrinsic

value of Time Vesting Options exercised was $9,858, $12,734 and $27,808 for the years ended December 28,

2013, December 29, 2012 and December 31, 2011, respectively.

Cash received from Time Vesting Options exercised during the years ended December 28,

2013, December 29, 2012 and December 31, 2011 was $16,187, $12,688 and $42,040, respectively.

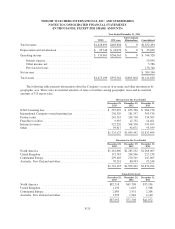

Restricted Stock Units

Pursuant to the restricted stock components of the Stock Plans, the Company’s Board of Directors authorized

the Company to enter into agreements under which certain employees received RSUs. The RSUs are exercisable

based on the terms outlined in the agreements. The RSUs vest over a period of three to five years. The fair value of

RSUs is determined using the closing market price of the Company’s common stock on the date of grant. A

summary of RSU activity under the Stock Plans for the year ended December 28, 2013 is presented below:

Shares

Weighted-Average

Grant-Date

Fair Value

Outstanding at December 29, 2012 ............................... 246 $50.67

Granted ................................................. 155 $38.40

Vested .................................................. (63) $27.08

Forfeited ................................................ (85) $56.23

Outstanding at December 28, 2013 ............................... 253 $47.11

The weighted-average grant-date fair value of RSUs granted was $38.40, $55.54 and $64.32 for the years

ended December 28, 2013, December 29, 2012 and December 31, 2011, respectively. The total fair value of

RSUs vested during the years ended December 28, 2013, December 29, 2012 and December 31, 2011 was

$1,705, $5,536 and $3,657, respectively.

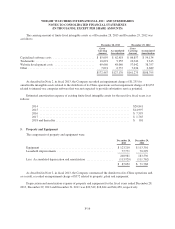

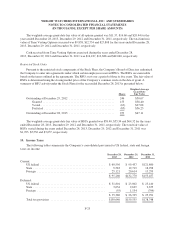

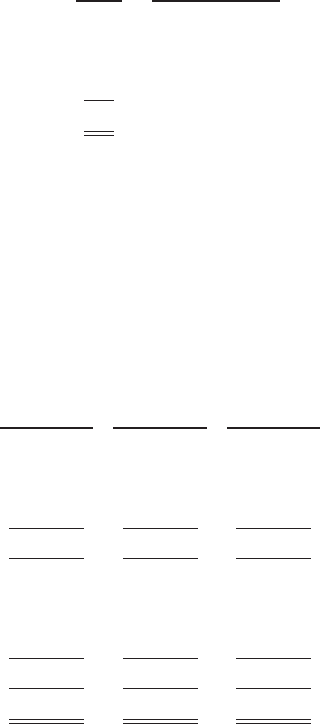

10. Income Taxes

The following tables summarize the Company’s consolidated provision for US federal, state and foreign

taxes on income:

December 28,

2013

December 29,

2012

December 31,

2011

Current:

US federal ............................................ $ 60,556 $ 99,437 $121,860

State ................................................. 9,583 12,719 18,298

Foreign .............................................. 25,121 20,614 13,299

$ 95,260 $132,770 $153,457

Deferred:

US federal ............................................ $ 31,801 $ 23,002 $ 23,410

State ................................................. 3,634 2,629 2,675

Foreign .............................................. (55) 1,134 (794)

$ 35,380 $ 26,765 $ 25,291

Total tax provision ..................................... $130,640 $159,535 $178,748

F-23