WeightWatchers 2013 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2013 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

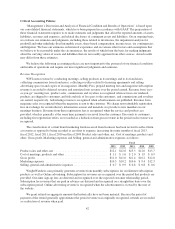

Critical Accounting Policies

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” is based upon

our consolidated financial statements, which have been prepared in accordance with GAAP. The preparation of

these financial statements requires us to make estimates and judgments that affect the reported amounts of assets,

liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an ongoing basis,

we evaluate our estimates and judgments, including those related to inventories, the impairment analysis for

goodwill and other indefinite-lived intangible assets, share-based compensation, income taxes, tax contingencies

and litigation. We base our estimates on historical experience and on various other factors and assumptions that

we believe to be reasonable under the circumstances, the results of which form the basis for making judgments

about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results

may differ from these estimates.

We believe the following accounting policies are most important to the portrayal of our financial condition

and results of operations and require our most significant judgments and estimates.

Revenue Recognition

WWI earns revenue by conducting meetings, selling products in its meetings and to its franchisees,

collecting commissions from franchisees, collecting royalties related to licensing agreements and selling

advertising space in and copies of its magazines. Monthly Pass, prepaid meeting fees and magazine subscription

revenue is recorded to deferred revenue and amortized into revenue over the period earned. Revenue from “pay-

as-you-go” meeting fees, product sales, commissions and royalties is recognized when services are rendered,

products are shipped to customers and title and risk of loss pass to the customers, and commissions and royalties

are earned, respectively. Advertising revenue is recognized when advertisements are published. Revenue from

magazine sales is recognized when the magazine is sent to the customer. We charge non-refundable registration

fees in exchange for an introductory information session and materials we provide to new members in our

meetings business. Revenue from these registration fees is recognized when the service and products are

provided, which is generally at the same time payment is received from the customer. Discounts to customers,

including free registration offers, are recorded as a deduction from gross revenue in the period such revenue was

recognized.

The classification of certain brand marketing funds received from licensees has been revised to reflect them

as revenue as opposed to being recorded as an offset to expense, increasing first nine months of fiscal 2013,

fiscal 2012, fiscal 2011, fiscal 2010 and fiscal 2009 Product sales and other, net, Cost of meetings, products and

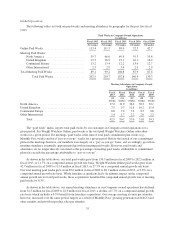

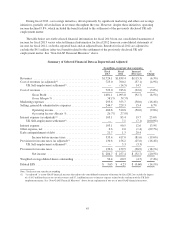

other, Gross profit, Marketing expenses and Selling, general and administrative expenses as follows:

Fiscal

2013 2012 2011 2010 2009

Product sales and other, net .................................... $12.1 $12.6 $13.3 $12.0 $13.7

Cost of meetings, products and other ............................. $ 1.1 $ 1.6 $ 2.0 $ 1.9 $ 0.9

Gross profit ................................................. $11.0 $11.0 $11.4 $10.2 $12.8

Marketing expenses .......................................... $10.3 $10.2 $10.6 $ 9.4 $12.3

Selling, general and administrative expenses ....................... $ 0.7 $ 0.9 $ 0.8 $ 0.8 $ 0.6

WeightWatchers.com primarily generates revenue from monthly subscriptions for our Internet subscription

products as well as Online advertising. Subscription fee revenues are recognized over the period that products are

provided. One-time sign-up fees are deferred and recognized over the expected customer relationship period.

Subscription fee revenues that are paid in advance are deferred and recognized on a straight-line basis over the

subscription period. Online advertising revenue is recognized when the advertisement is viewed by the user of

the website.

We grant refunds in aggregate amounts that historically have not been material. Because the period of

payment of the refund generally approximates the period revenue was originally recognized, refunds are recorded

as a reduction of revenue when paid.

42