US Cellular 2009 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2009 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

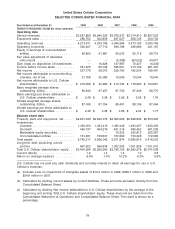

SELECTED CONSOLIDATED FINANCIAL DATA

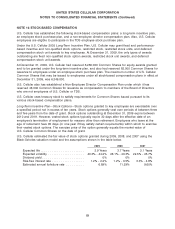

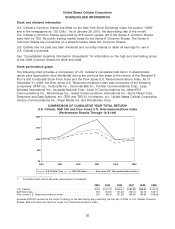

Year Ended or at December 31, 2009 2008 2007 2006 2005

(Dollars in thousands, except per share amounts)

Operating data

Service revenues .................. $3,927,859 $3,940,326 $3,679,237 $3,214,410 $2,827,022

Equipment sales ................... 286,752 302,859 267,027 258,745 203,743

Operating revenues ................ 4,214,611 4,243,185 3,946,264 3,473,155 3,030,765

Operating income(a) ................ 326,407 27,710 396,199 289,896 231,197

Equity in earnings of unconsolidated

entities ........................ 96,800 91,981 90,033 93,119 66,719

Fair value adjustment of derivative

instruments ..................... — — (5,388) (63,022) 44,977

Gain (loss) on disposition of investments . — 16,628 137,987 70,427 (6,203)

Income before income taxes .......... 351,879 66,128 546,501 313,138 261,347

Net income ...................... 237,776 58,073 329,790 192,534 165,491

Net income attributable to noncontrolling

interests, net of tax ............... 21,768 25,083 15,056 13,044 10,540

Net income attributable to U.S. Cellular

shareholders .................... $ 216,008 $ 32,990 $ 314,734 $ 179,490 $ 154,951

Basic weighted average shares

outstanding (000s) ................ 86,946 87,457 87,730 87,346 86,775

Basic earnings per share attributable to

U.S. Cellular shareholders .......... $ 2.48 $ 0.38 $ 3.59 $ 2.05 $ 1.79

Diluted weighted average shares

outstanding (000s) ................ 87,168 87,754 88,481 88,109 87,464

Diluted earnings per share attributable to

U.S. Cellular shareholders .......... $ 2.48 $ 0.38 $ 3.56 $ 2.04 $ 1.77

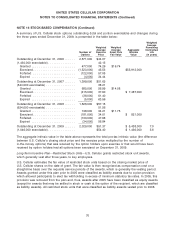

Balance sheet data

Property, plant and equipment, net ..... $2,601,338 $2,620,376 $2,595,096 $2,628,848 $2,553,029

Investments

Licenses ....................... 1,435,000 1,433,415 1,482,446 1,494,327 1,362,263

Goodwill ....................... 494,737 494,279 491,316 485,452 481,236

Marketable equity securities ......... — — 16,352 253,912 225,387

Unconsolidated entities ............ 161,481 156,637 157,693 150,325 172,093

Total assets ...................... 5,745,217 5,566,042 5,611,874 5,680,616 5,416,233

Long-term debt (excluding current

portion) ........................ 867,522 996,636 1,002,293 1,001,839 1,161,241

Total U.S. Cellular shareholders’ equity . . . $3,404,296 $3,206,642 $3,196,156 $2,993,279 $2,741,038

Current ratio(b) .................... 1.6 1.4 1.4 1.0 0.8

Return on average equity(c) .......... 6.5% 1.0% 10.2% 6.3% 5.8%

U.S. Cellular has not paid any cash dividends and currently intends to retain all earnings for use in U.S.

Cellular’s business.

(a) Includes Loss on impairment of intangible assets of $14.0 million in 2009, $386.7 million in 2008 and

$24.9 million in 2007.

(b) Calculated by dividing current assets by current liabilities. These amounts are taken directly from the

Consolidated Balance Sheet.

(c) Calculated by dividing Net income attributable to U.S. Cellular shareholders by the average of the

beginning and ending Total U.S. Cellular shareholders’ equity. These amounts are taken from the

Consolidated Statement of Operations and Consolidated Balance Sheet. The result is shown as a

percentage.

79