US Cellular 2009 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2009 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

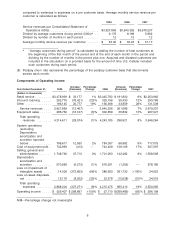

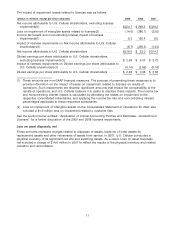

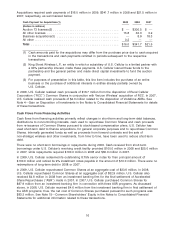

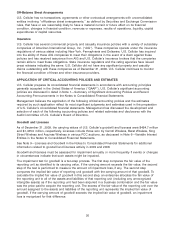

Interest expense

Interest expense is summarized by related debt instrument in the following table:

Year Ended December 31, 2009 2008 2007

(Dollars in thousands)

6.7% senior notes .................................. $37,084 $37,085 $37,084

7.5% senior notes .................................. 25,114 25,113 25,113

8.75% senior notes(1) ............................... 11,166 11,383 11,380

Forward contracts(2) ................................ — — 3,514

Revolving credit facility ............................... 3,011 3,061 4,967

Other ........................................... (8) 548 2,621

Total interest expense ................................ $76,367 $77,190 $84,679

(1) The 8.75% senior notes were due November 1, 2032. Interest was paid quarterly. U.S. Cellular

redeemed the notes in whole at a redemption price equal to 100% of the principal amount plus

accrued and unpaid interest on December 24, 2009, which resulted in a total redemption

payment of $131.7 million.

(2) In May 2002, U.S. Cellular entered into the forward contracts relating to its investment in

Vodafone ADRs. Taken together, the forward contracts allowed U.S. Cellular to borrow an

aggregate of $159.9 million against the Vodafone ADRs. The forward contracts bore interest,

payable quarterly, at the London InterBank Offered Rate (‘‘LIBOR’’) plus 50 basis points.

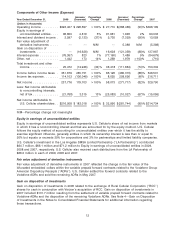

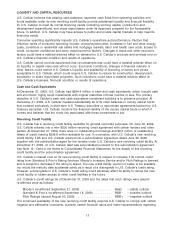

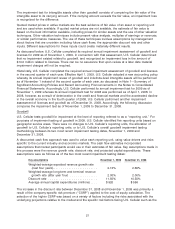

Income tax expense

The effective tax rates on Income before income taxes (‘‘pre-tax income’’) for 2009, 2008 and 2007 were

32.4%, 12.2% and 39.7%, respectively. The following significant discrete and other items impacted

income tax expense for these years:

2009—Includes tax benefits of $7.7 million and $7.2 million resulting from a state tax law change and the

release of state valuation allowances, respectively.

2008—Includes tax benefits of $7.6 million and $2.5 million resulting from a change in filing positions in

certain states and the resolution of a prior period tax issue, respectively. The percentage impact of these

benefits was magnified due to the 2008 Loss on impairment of intangible assets of $386.7 million, which

decreased pre-tax income.

2007—Includes tax expense of $3.3 million and $4.6 million due to the increase in valuation allowances

resulting from the restructuring of certain legal entities and the write-off of deferred tax assets for certain

partnerships, respectively.

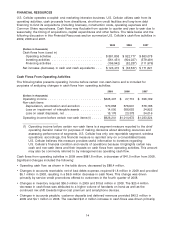

INFLATION

Management believes that inflation affects U.S. Cellular’s business to no greater or lesser extent than the

general economy.

RECENT ACCOUNTING PRONOUNCEMENTS

In general, recent accounting pronouncements did not have and are not expected to have a significant

effect on U.S. Cellular’s financial condition and results of operations.

See Note 1—Summary of Significant Accounting Policies and Recent Accounting Pronouncements in the

Notes to Consolidated Financial Statements for information on recent accounting pronouncements.

13