US Cellular 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 6 VARIABLE INTEREST ENTITIES (VIEs) (Continued)

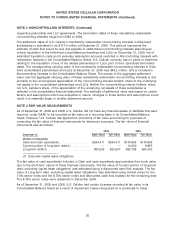

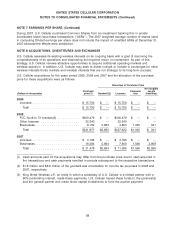

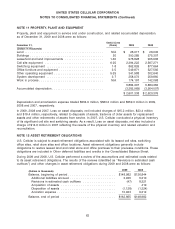

The following table presents the classification of the consolidated VIEs’ assets and liabilities in

U.S. Cellular’s Consolidated Balance Sheet.

December 31, 2009 2008

(Dollars in thousands)

Assets

Cash .......................................... $ 679 $ 684

Other current assets .............................. 393 63

Licenses ....................................... 487,962 487,962

Property, plant and equipment ....................... 440 —

Total assets ..................................... $489,474 $488,709

Liabilities

Customer deposits and deferred revenues ............... $ 70 $ 63

Total liabilities ................................... $ 70 $ 63

Other Related Matters

U.S. Cellular may agree to make additional capital contributions and/or advances to the VIEs discussed

above and/or to their general partners to provide additional funding for the development of licenses

granted in the various auctions. U.S. Cellular may finance such amounts with a combination of cash on

hand, borrowings under its revolving credit agreement and/or long-term debt. There is no assurance that

U.S. Cellular will be able to obtain additional financing on commercially reasonable terms or at all to

provide such financial support.

The general partner of each of these VIEs has the exclusive right to manage, operate, and control the

limited partnerships and make all decisions to carry on the business of the partnerships; however, the

general partner needs consent of the partners to sell or lease certain licenses, to make certain large

expenditures, admit other partners, or liquidate the limited partnerships. Based on the current ownership

interests, the general partner would need the consent of the U.S. Cellular subsidiary that is a limited

partner in each of the respective partnerships.

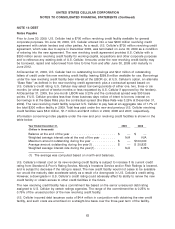

The limited partnership agreements also provide the general partner with a put option whereby the

general partner may require the limited partner, a subsidiary of U.S. Cellular, to purchase its interest in

the limited partnership. The general partner’s put options related to its interests in Carroll Wireless, Barat

Wireless, King Street Wireless and Aquinas Wireless will become exercisable in 2011, 2017, 2019 and

2020, respectively. The put option price is determined pursuant to a formula that takes into consideration

fixed interest rates and the market value of U.S. Cellular’s Common Shares. Upon exercise of the put

option, the general partner is required to repay borrowings due to U.S. Cellular. If the general partner

does not elect to exercise its put option, the general partner may trigger an appraisal process in which

the limited partner (a subsidiary of U.S. Cellular) may have the right, but not the obligation, to purchase

the general partner’s interest in the limited partnership at a price and on other terms and conditions

specified in the limited partnership agreement. In accordance with requirements under GAAP,

U.S. Cellular is required to calculate a theoretical redemption value for all of the puts assuming they are

exercisable at the end of each reporting period, even though such exercise is not contractually

permitted. Pursuant to GAAP, this theoretical redemption value, net of amounts payable to U.S. Cellular

for loans (and accrued interest thereon) made by U.S. Cellular to the general partners, is recorded as a

component of Noncontrolling interests with redemption features in U.S. Cellular’s Consolidated Balance

Sheet. Also per GAAP, changes in the redemption value of the put options, net of interest accrued on the

56