US Cellular 2009 Annual Report Download - page 25

Download and view the complete annual report

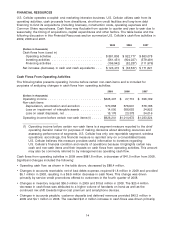

Please find page 25 of the 2009 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.LIQUIDITY AND CAPITAL RESOURCES

U.S. Cellular believes that existing cash balances, expected cash flows from operating activities and

funds available under its new revolving credit facility provide substantial liquidity and financial flexibility

for U.S. Cellular to meet its normal financing needs (including working capital, construction and

development expenditures, and share repurchases under its approved program) for the foreseeable

future. In addition, U.S. Cellular may have access to public and private capital markets to help meet its

financing needs.

Consumer spending significantly impacts U.S. Cellular’s operations and performance. Factors that

influence levels of consumer spending include: unemployment rates, increases in fuel and other energy

costs, conditions in residential real estate and mortgage markets, labor and health care costs, access to

credit, consumer confidence and other macroeconomic factors. Changes in these and other economic

factors could have a material adverse effect on demand for U.S. Cellular’s products and services and on

U.S. Cellular’s financial condition and results of operations.

U.S. Cellular cannot provide assurances that circumstances that could have a material adverse affect on

its liquidity or capital resources will not occur. Economic conditions, changes in financial markets or

other factors could restrict U.S. Cellular’s liquidity and availability of financing on terms and prices

acceptable to U.S. Cellular, which could require U.S. Cellular to reduce its construction, development,

acquisition or share repurchase programs. Such reductions could have a material adverse effect on

U.S. Cellular’s business, financial condition or results of operations.

Cash and Cash Equivalents

At December 31, 2009, U.S. Cellular had $294.4 million in cash and cash equivalents, which include cash

and short-term, highly liquid investments with original maturities of three months or less. The primary

objective of U.S. Cellular’s cash and cash equivalents investment activities is to preserve principal. At

December 31, 2009, U.S. Cellular invested substantially all of its cash balances in money market funds

that invested exclusively in short-term U.S. Treasury securities or repurchase agreements backed by U.S.

Treasury securities. U.S. Cellular monitors the financial viability of the money market funds in which it

invests and believes that the credit risk associated with these investments is low.

Revolving Credit Facility

U.S. Cellular has a revolving credit facility available for general corporate purposes. On June 30, 2009,

U.S. Cellular entered into a new $300 million revolving credit agreement with certain lenders and other

parties. At December 31, 2009, there were no outstanding borrowings and $0.2 million of outstanding

letters of credit, leaving $299.8 million available for use. In connection with U.S. Cellular’s new revolving

credit facility, TDS and U.S. Cellular entered into a subordination agreement dated June 30, 2009

together with the administrative agent for the lenders under U.S. Cellular’s new revolving credit facility. At

December 31, 2009, no U.S. Cellular debt was subordinated pursuant to this subordination agreement.

See Note 13—Debt in the Notes to Consolidated Financial Statements for the details of this revolving

credit facility and the subordination agreement.

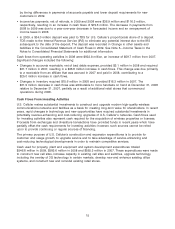

U.S. Cellular’s interest cost on its new revolving credit facility is subject to increase if its current credit

rating from Standard & Poor’s Rating Services, Moody’s Investors Service and/or Fitch Ratings is lowered

and is subject to decrease if the rating is raised. The new credit facility would not cease to be available

nor would the maturity date accelerate solely as a result of a downgrade in U.S. Cellular’s credit rating.

However, a downgrade in U.S. Cellular’s credit rating could adversely affect its ability to renew the new

credit facility or obtain access to other credit facilities in the future.

U.S. Cellular’s credit ratings as of December 31, 2009 and the dates that such ratings were issued/

re-affirmed were as follows:

Moody’s (re-affirmed September 21, 2009) ................. Baa2 —stable outlook

Standard & Poor’s (re-affirmed September 18, 2009) .......... BBBǁ—positive outlook

Fitch Ratings (issued August 20, 2009) .................... BBB+ —negative outlook

The continued availability of the new revolving credit facility requires U.S. Cellular to comply with certain

negative and affirmative covenants, maintain certain financial ratios and make representations regarding

17