US Cellular 2009 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2009 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 2 NONCONTROLLING INTERESTS (Continued)

respective partnership and LLC agreements. The termination dates of these mandatorily redeemable

noncontrolling interests range from 2085 to 2094.

The settlement value of U.S. Cellular’s mandatorily redeemable noncontrolling interests in finite-lived

subsidiaries is estimated to be $137.0 million at December 31, 2009. This amount represents the

estimate of cash that would be due and payable to settle these noncontrolling interests assuming an

orderly liquidation of the finite-lived consolidated partnerships and LLCs on December 31, 2009, net of

estimated liquidation costs and it excludes redemption amounts recorded in Noncontrolling interests with

redemption features in the Consolidated Balance Sheet. U.S. Cellular currently has no plans or intentions

relating to the liquidation of any of the related partnerships or LLCs prior to their scheduled termination

dates. The corresponding carrying value of the mandatorily redeemable noncontrolling interests in finite-

lived consolidated partnerships and LLCs at December 31, 2009 was $48.2 million, and is included in

Noncontrolling interests in the Consolidated Balance Sheet. The excess of the aggregate settlement

value over the aggregate carrying value of these mandatorily redeemable noncontrolling interests is due

primarily to the unrecognized appreciation of the noncontrolling interest holders’ share of the underlying

net assets in the consolidated partnerships and LLCs. Neither the noncontrolling interest holders’ share,

nor U.S. Cellular’s share, of the appreciation of the underlying net assets of these subsidiaries is

reflected in the consolidated financial statements. The estimate of settlement value was based on certain

factors and assumptions which are subjective in nature. Changes in those factors and assumptions could

result in a materially larger or smaller settlement amount.

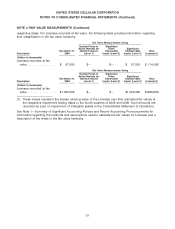

NOTE 3 FAIR VALUE MEASUREMENTS

As of December 31, 2009 and 2008, U.S. Cellular did not have any financial assets or liabilities that were

required, under GAAP, to be recorded at fair value on a recurring basis in its Consolidated Balance

Sheet. However, U.S. Cellular has applied the provisions of fair value accounting for purposes of

computing the fair value of financial instruments for disclosure purposes. The fair value of financial

instruments was as follows:

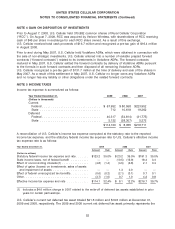

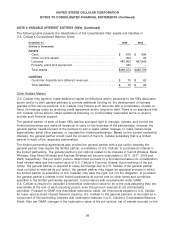

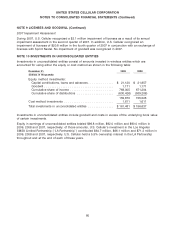

2009 2008

December 31, Book Value Fair Value Book Value Fair Value

(Dollars in thousands)

Cash and cash equivalents ................ $294,411 $294,411 $170,996 $170,996

Current portion of long-term debt(1) ......... — — 10,000 9,887

Long-term debt(1) ...................... 863,202 853,937 992,748 663,432

(1) Excludes capital lease obligations

The fair value of cash equivalents included in Cash and cash equivalents approximates their book value

due to the short-term nature of these financial instruments. The fair value of Current portion of long-term

debt, excluding capital lease obligations, was estimated using a discounted cash flow analysis. The fair

value of Long-term debt, excluding capital lease obligations, was estimated using market prices for the

7.5% senior notes and the 8.75% senior notes and discounted cash flow analysis for the remaining debt.

The 8.75% senior notes were redeemed in December 2009.

As of December 31, 2009 and 2008, U.S. Cellular had certain Licenses recorded at fair value in its

Consolidated Balance Sheet as a result of impairment losses recognized at or proximate to these

50