US Cellular 2009 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2009 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

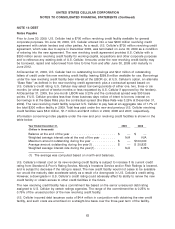

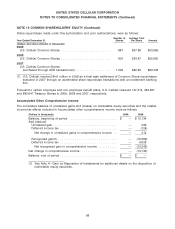

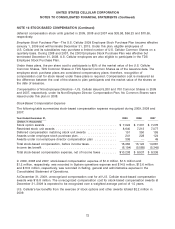

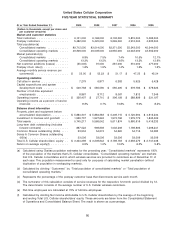

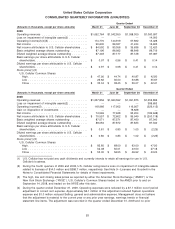

NOTE 17 SUPPLEMENTAL CASH FLOWS

Following are supplemental cash flow disclosures regarding interest paid and income taxes paid.

Year Ended December 31, 2009 2008 2007

(Dollars in thousands)

Interest paid ........................................... $77,692 $ 78,223 $ 84,095

Income taxes paid ....................................... $36,863 $116,525 $212,578

Following are supplemental cash flow disclosures regarding transactions related to stock-based

compensation awards:

Year Ended December 31, 2009 2008 2007

(Dollars in thousands)

Common Shares withheld(1) ................................ 200,025 368,231 716,446

Aggregate value of Common Shares withheld .................... $ 7,622 $20,055 $ 59,969

Cash receipts upon exercise of stock options .................... $ 1,572 $ 3,588 $ 23,582

Cash disbursements for payment of taxes(2) ..................... (1,654) (5,876) (13,509)

Net cash receipts (disbursements) from exercise of stock options and

vesting of other stock awards .............................. $ (82) $ (2,288) $ 10,073

(1) Such shares were withheld to cover the exercise price of stock options, if applicable, and required

tax withholdings.

(2) In certain situations, U.S. Cellular withholds shares that are issuable upon the exercise of stock

options or the vesting of restricted shares to cover, and with a value equivalent to, the exercise price

and/or the amount of taxes required to be withheld from the stock award holder at the time of the

exercise or vesting. U.S. Cellular then pays the amount of the required tax withholdings to the taxing

authorities in cash.

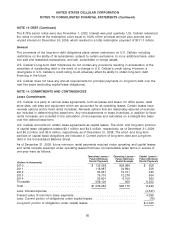

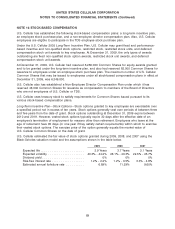

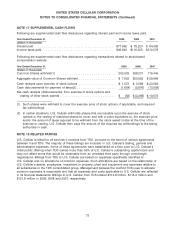

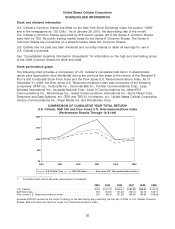

NOTE 18 RELATED PARTIES

U.S. Cellular is billed for all services it receives from TDS, pursuant to the terms of various agreements

between it and TDS. The majority of these billings are included in U.S. Cellular’s Selling, general and

administrative expenses. Some of these agreements were established at a time prior to U.S. Cellular’s

initial public offering when TDS owned more than 90% of U.S. Cellular’s outstanding capital stock and

may not reflect terms that would be obtainable from an unrelated third party through arms-length

negotiations. Billings from TDS to U.S. Cellular are based on expenses specifically identified to

U.S. Cellular and on allocations of common expenses. Such allocations are based on the relationship of

U.S. Cellular’s assets, employees, investment in property, plant and equipment and expenses relative to

all subsidiaries in the TDS consolidated group. Management believes the method TDS uses to allocate

common expenses is reasonable and that all expenses and costs applicable to U.S. Cellular are reflected

in its financial statements. Billings to U.S. Cellular from TDS totaled $114.8 million, $113.3 million and

$121.8 million in 2009, 2008 and 2007, respectively.

73