US Cellular 2009 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2009 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

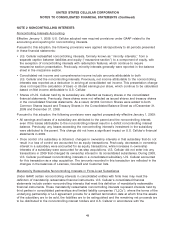

NOTE 6 VARIABLE INTEREST ENTITIES (VIEs)

From time to time, the FCC conducts auctions through which additional spectrum is made available for

the provision of wireless services. U.S. Cellular participated in spectrum auctions indirectly through its

interests in Aquinas Wireless L.P. (‘‘Aquinas Wireless’’), King Street Wireless L.P. (‘‘King Street Wireless’’),

Barat Wireless L.P. (‘‘Barat Wireless’’) and Carroll Wireless L.P. (‘‘Carroll Wireless’’), collectively, the

‘‘limited partnerships.’’ Each entity qualified as a ‘‘designated entity’’ and thereby was eligible for bid

credits with respect to licenses purchased in accordance with the rules defined by the FCC for each

auction. In most cases, the bidding credits resulted in a 25% discount from the gross winning bid.

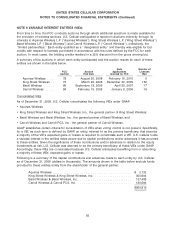

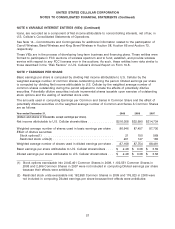

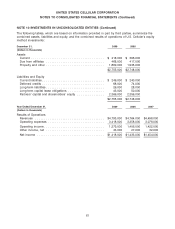

A summary of the auctions in which each entity participated and the auction results for each of these

entities are shown in the table below.

Date Number of

FCC Auction Applications Licenses

Auction End Date Granted by FCC Won

Aquinas Wireless .... 78 August 20, 2008 February 16, 2010 5

King Street Wireless . . 73 March 20, 2008 December 30, 2009 152

Barat Wireless ...... 66 September 18, 2006 April 30, 2007 17

Carroll Wireless ..... 58 February 15, 2005 January 6, 2006 16

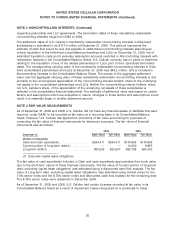

Consolidated VIEs

As of December 31, 2009, U.S. Cellular consolidates the following VIEs under GAAP:

• Aquinas Wireless;

• King Street Wireless and King Street Wireless, Inc., the general partner of King Street Wireless;

• Barat Wireless and Barat Wireless, Inc., the general partner of Barat Wireless; and

• Carroll Wireless and Carroll PCS, Inc., the general partner of Carroll Wireless.

GAAP establishes certain criteria for consolidation of VIEs when voting control is not present. Specifically,

for a VIE, as such term is defined by GAAP, an entity, referred to as the primary beneficiary, that absorbs

a majority of the VIE’s expected gains or losses is required to consolidate such a VIE. U.S. Cellular holds

a variable interest in the entities listed above due to capital contributions and/or advances it has provided

to these entities. Given the significance of these contributions and/or advances in relation to the equity

investments at risk, U.S. Cellular was deemed to be the primary beneficiary of these VIEs under GAAP.

Accordingly, these VIEs are consolidated because U.S. Cellular anticipates benefiting from or absorbing

a majority of these VIEs’ expected gains or losses.

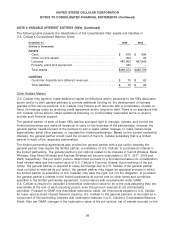

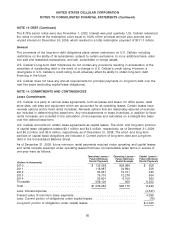

Following is a summary of the capital contributions and advances made to each entity by U.S. Cellular

as of December 31, 2009 (dollars in thousands). The amounts shown in the table below exclude funds

provided to these entities solely from the shareholder of the general partner.

Aquinas Wireless ........................................... $ 2,132

King Street Wireless & King Street Wireless, Inc. .................... 300,604

Barat Wireless & Barat Wireless, Inc. ............................ 127,485

Carroll Wireless & Carroll PCS, Inc. ............................. 130,594

$560,815

55