US Cellular 2009 Annual Report Download - page 26

Download and view the complete annual report

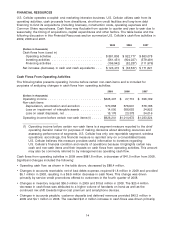

Please find page 26 of the 2009 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.certain matters at the time of each borrowing. The covenants also prescribe certain terms associated

with intercompany loans from TDS or TDS subsidiaries to U.S. Cellular or U.S. Cellular subsidiaries.

U.S. Cellular believes it was in compliance as of December 31, 2009 with all covenants and requirements

set forth in its new revolving credit facility. There were no intercompany loans at December 31, 2009 or

2008.

Long-Term Financing

U.S. Cellular’s long-term debt indenture does not contain any provisions resulting in acceleration of the

maturities of outstanding debt in the event of a change in U.S. Cellular’s credit rating. However, a

downgrade in U.S. Cellular’s credit rating could adversely affect its ability to obtain long-term debt

financing in the future. U.S. Cellular believes it was in compliance as of December 31, 2009 with all

covenants and other requirements set forth in its long-term debt indenture. U.S. Cellular has not failed to

make nor does it expect to fail to make any scheduled payment of principal or interest under such

indenture.

The long-term debt principal payments due for the next five years represent less than 1% of the total

long-term debt obligation at December 31, 2009. Refer to the section Market Risk—Long-Term Debt, for

additional information regarding required principal payments and the weighted average interest rates

related to U.S. Cellular’s long-term debt.

U.S. Cellular, at its discretion, may from time to time seek to retire or purchase its outstanding debt

through cash purchases and/or exchanges for other securities, in open market purchases, privately

negotiated transactions, tender offers, exchange offers or otherwise. Such repurchases or exchanges, if

any, will depend on prevailing market conditions, liquidity requirements, contractual restrictions and other

factors. The amounts involved may be material.

In December 2009, U.S. Cellular redeemed in whole its $130.0 million senior notes which carried an

interest rate of 8.75%. These notes were scheduled to mature in 2032.

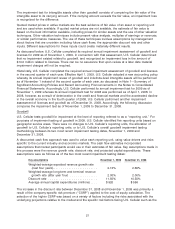

Capital Expenditures

U.S. Cellular’s capital expenditures for 2010 are expected to be approximately $600 million. These

expenditures are expected to be for the following general purposes:

• Expand and enhance U.S. Cellular’s coverage in its service areas;

• Provide additional capacity to accommodate increased network usage by current customers;

• Overlay 3G technology in certain markets;

• Develop and enhance office systems; and

• Develop new billing and other customer management-related systems and platforms.

U.S. Cellular plans to finance its capital expenditures program for 2010 using cash on hand, cash flows

from operating activities and, if necessary, short-term debt.

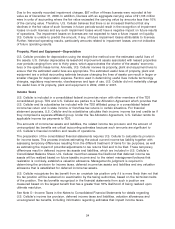

Suppliers

U.S. Cellular depends upon certain key suppliers to provide it with handsets, equipment, services or

content to continue its network build and upgrade and to operate its business. U.S. Cellular does not

have operational or financial control over any of such key suppliers and has limited influence with

respect to the manner in which these key suppliers conduct their businesses. If these key suppliers

experience financial difficulties and are unable to provide equipment, services or content to U.S. Cellular

on a timely basis or cease to provide such equipment, services or content or if such key suppliers

otherwise fail to honor their obligations to U.S. Cellular, U.S. Cellular may be unable to maintain and

upgrade its network or provide services to its customers in a competitive manner, or could suffer other

disruptions to its business. In that event, U.S. Cellular’s business, financial condition or results of

operations could be adversely affected. U.S. Cellular monitors the financial condition of its key suppliers

through its risk management process.

18