US Cellular 2009 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2009 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

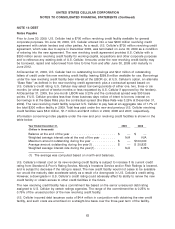

NOTE 13 DEBT

Notes Payable

Prior to June 30, 2009, U.S. Cellular had a $700 million revolving credit facility available for general

corporate purposes. On June 30, 2009, U.S. Cellular entered into a new $300 million revolving credit

agreement with certain lenders and other parties. As a result, U.S. Cellular’s $700 million revolving credit

agreement, which was due to expire in December 2009, was terminated on June 30, 2009 as a condition

of entering into the new agreement. The new revolving credit agreement provides U.S. Cellular with a

$300 million senior revolving credit facility for working capital, acquisitions and other corporate purposes

and to refinance any existing debt of U.S. Cellular. Amounts under the new revolving credit facility may

be borrowed, repaid and reborrowed from time to time from and after June 30, 2009 until maturity in

June 2012.

At December 31, 2009, U.S. Cellular had no outstanding borrowings and $0.2 million of outstanding

letters of credit under the new revolving credit facility, leaving $299.8 million available for use. Borrowings

under the new revolving credit facility bear interest at the LIBOR (or, at U.S. Cellular’s option, an alternate

‘‘Base Rate’’ as defined in the new revolving credit agreement) plus a contractual spread based on

U.S. Cellular’s credit rating. U.S. Cellular may select borrowing periods of either one, two, three or six

months (or other period of twelve months or less requested by U.S. Cellular if approved by the lenders).

At December 31, 2009, the one-month LIBOR was 0.23% and the contractual spread was 300 basis

points. If U.S. Cellular provides less than three business days notice of intent to borrow, interest on

borrowings is at the Base Rate plus the contractual spread (the Base Rate was 3.25% at December 31,

2009). The new revolving credit facility required U.S. Cellular to pay fees at an aggregate rate of 1.7% of

the total $300 million facility in 2009. Total fees paid under the new and previous U.S. Cellular revolving

credit facilities were $5.9 million, $1.7 million and $2.8 million in 2009, 2008 and 2007, respectively.

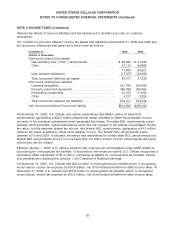

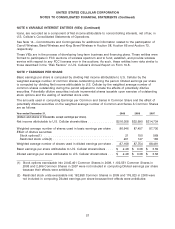

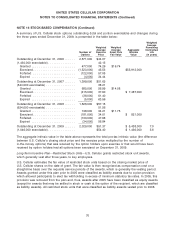

Information concerning notes payable under the new and prior revolving credit facilities is shown in the

table below:

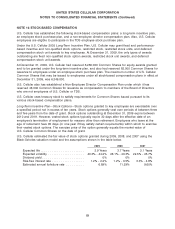

Year Ended December 31, 2009 2008

(Dollars in thousands)

Balance at the end of the year ........................ $ — $ —

Weighted average interest rate at the end of the year ........ N/A N/A

Maximum amount outstanding during the year ............. $ — $100,000

Average amount outstanding during the year(1) ............ $ — $ 20,833

Weighted average interest rate during the year(1) ........... N/A 3.38%

(1) The average was computed based on month-end balances.

U.S. Cellular’s interest cost on its new revolving credit facility is subject to increase if its current credit

rating from Standard & Poor’s Rating Service, Moody’s Investors Service and/or Fitch Ratings is lowered,

and is subject to decrease if the rating is raised. The new credit facility would not cease to be available

nor would the maturity date accelerate solely as a result of a downgrade in U.S. Cellular’s credit rating.

However, a downgrade in U.S. Cellular’s credit rating could adversely affect its ability to renew the new

credit facility or obtain access to other credit facilities in the future.

The new revolving credit facility has a commitment fee based on the senior unsecured debt rating

assigned to U.S. Cellular by certain ratings agencies. The range of the commitment fee is 0.25% to

0.75% of the unused portion of the new revolving credit facility.

U.S. Cellular incurred debt issuance costs of $4.4 million in conjunction with obtaining the new credit

facility, and such costs are amortized on a straight-line basis over the three-year term of the facility.

63