US Cellular 2009 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2009 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

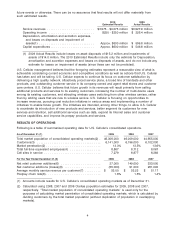

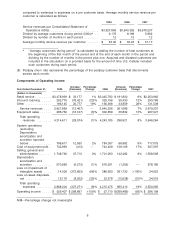

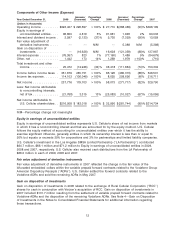

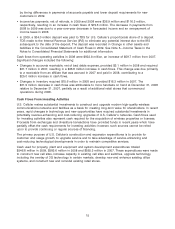

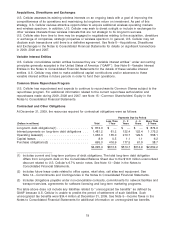

Components of Other Income (Expense)

Increase/ Percentage Increase/ Percentage

Year Ended December 31, 2009 (Decrease) Change 2008 (Decrease) Change 2007

(Dollars in thousands)

Operating income ......... $326,407 $ 298,697 >100% $ 27,710 $(368,489) (93)% $396,199

Equity in earnings of

unconsolidated entities .... 96,800 4,819 5% 91,981 1,948 2% 90,033

Interest and dividend income . 3,597 (2,133) (37)% 5,730 (7,329) (56)% 13,059

Fair value adjustment of

derivative instruments ..... — — N/M — 5,388 N/M (5,388)

Gain on disposition of

investments ............ — (16,628) N/M 16,628 (121,359) (88)% 137,987

Interest expense .......... (76,367) 823 1% (77,190) 7,489 9% (84,679)

Other, net ............... 1,442 173 14% 1,269 1,979 >100% (710)

Total investment and other

income ............... 25,472 (12,946) (34)% 38,418 (111,884) (74)% 150,302

Income before income taxes . 351,879 285,751 >100% 66,128 (480,373) (88)% 546,501

Income tax expense ........ 114,103 (106,048) >100% 8,055 208,656 96% 216,711

Net income .............. 237,776 179,703 >100% 58,073 (271,717) (82)% 329,790

Less: Net income attributable

to noncontrolling interests,

net of tax .............. (21,768) 3,315 13% (25,083) (10,027) (67)% (15,056)

Net income attributable to

U.S. Cellular shareholders . . $216,008 $ 183,018 >100% $ 32,990 $(281,744) (90)% $314,734

N/M—Percentage change not meaningful

Equity in earnings of unconsolidated entities

Equity in earnings of unconsolidated entities represents U.S. Cellular’s share of net income from markets

in which it has a noncontrolling interest and that are accounted for by the equity method. U.S. Cellular

follows the equity method of accounting for unconsolidated entities over which it has the ability to

exercise significant influence, generally entities in which its ownership interest is less than or equal to

50% but equals or exceeds 20% for corporations and 3% for partnerships and limited liability companies.

U.S. Cellular’s investment in the Los Angeles SMSA Limited Partnership (‘‘LA Partnership’’) contributed

$64.7 million, $66.1 million and $71.2 million to Equity in earnings of unconsolidated entities in 2009,

2008 and 2007, respectively. U.S. Cellular also received cash distributions from the LA Partnership of

$66.0 million in each of 2009, 2008 and 2007.

Fair value adjustment of derivative instruments

Fair value adjustment of derivative instruments in 2007 reflected the change in the fair value of the

bifurcated embedded collars within the variable prepaid forward contracts related to the Vodafone Group

American Depository Receipts (‘‘ADRs’’). U.S. Cellular settled the forward contracts related to the

Vodafone ADRs and sold the remaining ADRs in May 2007.

Gain on disposition of investments

Gain on disposition of investments in 2008 related to the exchange of Rural Cellular Corporation (‘‘RCC’’)

shares for cash in conjunction with Verizon’s acquisition of RCC. Gain on disposition of investments in

2007 included $131.7 million resulting from the settlement of variable prepaid forward contracts related to

Vodafone ADRs and the disposition of the remaining Vodafone ADRs. See Note 4—Gain on Disposition

of Investments in the Notes to Consolidated Financial Statements for additional information regarding

these transactions.

12