US Cellular 2009 Annual Report Download - page 11

Download and view the complete annual report

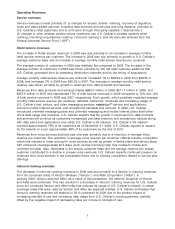

Please find page 11 of the 2009 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.– Continued enhancements to its wireless networks, including expansion of 3G services and potential

deployments of new technology;

– Increasing costs of regulatory compliance; and

– Uncertainty in future eligible telecommunication carrier (‘‘ETC’’) funding.

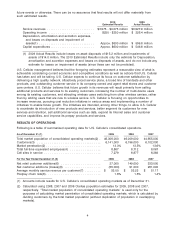

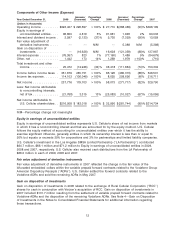

• Investment and other income (expense) totaled $25.5 million in 2009 and $38.4 million in 2008. The

decrease was due primarily to a gain on disposition of Rural Cellular Corporation (‘‘RCC’’) shares of

$16.4 million in conjunction with Verizon’s acquisition of RCC in 2008.

• Net income attributable to U.S. Cellular increased $183.0 million to $216.0 million in 2009 compared to

$33.0 million in 2008, due primarily to lower Losses on impairment of intangible assets, partially offset

by lower operating income excluding impairments. Basic earnings per share was $2.48 in 2009, which

was $2.10 higher than in 2008 and Diluted earnings per share was $2.48, which was $2.10 higher than

in 2008.

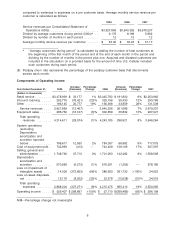

Cash Flows and Investments

U.S. Cellular believes that cash on hand, expected future cash flows from operating activities and

sources of external financing provide substantial liquidity and financial flexibility and are sufficient to

permit U.S. Cellular to finance its contractual obligations and anticipated capital expenditures for the

foreseeable future. U.S. Cellular continues to seek to maintain a strong balance sheet and an investment

grade credit rating.

See ‘‘Financial Resources’’ and ‘‘Liquidity and Capital Resources’’ below for additional information

related to cash flows and investments, including information related to U.S. Cellular’s new revolving

credit agreement.

Recent Developments

Congress recently enacted the American Recovery and Reinvestment Act of 2009, or the Recovery Act,

which provides, among other things, for an aggregate appropriation of $7.2 billion to fund grants and

loans to provide broadband infrastructure, access and equipment to consumers residing in rural,

unserved or underserved areas of the United States. U.S. Cellular submitted applications for grants in the

first round of funding in the amount of $23.5 million; U.S. Cellular has been notified that those

applications were not granted. U.S. Cellular is currently considering submitting additional applications for

grants in the second round of funding, which applications are due March 15, 2010. There is no

assurance that U.S. Cellular will receive any grants of Recovery Act funds. The distribution of Recovery

Act funds to other telecommunications service providers could impact competition in certain of

U.S. Cellular’s service areas.

2010 Estimates

U.S. Cellular expects the factors described above to impact revenues and operating income for the next

several quarters. Any changes in the above factors, as well as the effects of other drivers of

U.S. Cellular’s operating results, may cause revenues and operating income to fluctuate over the next

several quarters.

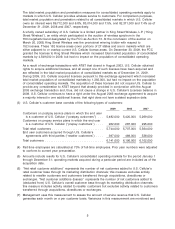

U.S. Cellular’s estimates of full-year 2010 results are shown below. Such estimates represent

U.S. Cellular’s views as of the date of filing of U.S. Cellular’s Form 10-K for the year ended December 31,

2009. Such forward-looking statements should not be assumed to be accurate as of any future date.

U.S. Cellular undertakes no duty to update such information whether as a result of new information,

3