US Cellular 2009 Annual Report Download - page 28

Download and view the complete annual report

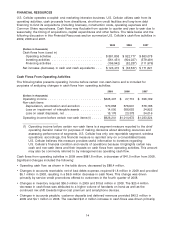

Please find page 28 of the 2009 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Off-Balance Sheet Arrangements

U.S. Cellular has no transactions, agreements or other contractual arrangements with unconsolidated

entities involving ‘‘off-balance sheet arrangements,’’ as defined by Securities and Exchange Commission

rules, that have or are reasonably likely to have a material current or future effect on its financial

condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital

expenditures or capital resources.

Insurance

U.S. Cellular has several commercial property and casualty insurance policies with a variety of subsidiary

companies of American International Group, Inc. (‘‘AIG’’). These companies operate under the insurance

regulations of various states including New York, Pennsylvania and Delaware. U.S. Cellular has inquired

into the ability of these AIG companies to meet their obligations in the event of a claim against these

policies and has received assurance from AIG and U.S. Cellular’s insurance brokers that the companies

remain able to meet these obligations. State insurance regulators and the rating agencies have issued

press releases indicating the same. U.S. Cellular did not have any significant property and casualty

claims outstanding with these companies as of December 31, 2009. U.S. Cellular continues to monitor

the financial condition of these and other insurance providers.

APPLICATION OF CRITICAL ACCOUNTING POLICIES AND ESTIMATES

U.S. Cellular prepares its consolidated financial statements in accordance with accounting principles

generally accepted in the United States of America (‘‘GAAP’’). U.S. Cellular’s significant accounting

policies are discussed in detail in Note 1—Summary of Significant Accounting Policies and Recent

Accounting Pronouncements in the Notes to Consolidated Financial Statements.

Management believes the application of the following critical accounting policies and the estimates

required by such application reflect its most significant judgments and estimates used in the preparation

of U.S. Cellular’s consolidated financial statements. Management has discussed the development and

selection of each of the following accounting policies and related estimates and disclosures with the

Audit Committee of U.S. Cellular’s Board of Directors.

Goodwill and Licenses

As of December 31, 2009, the carrying values of U.S. Cellular’s goodwill and licenses were $494.7 million

and $1,435.0 million, respectively. Licenses include those won by Carroll Wireless, Barat Wireless, King

Street Wireless and Aquinas Wireless in various FCC auctions, as discussed in Note 6—Variable Interest

Entities in the Notes to Consolidated Financial Statements.

See Note 9—Licenses and Goodwill in the Notes to Consolidated Financial Statements for additional

information related to goodwill and licenses activity in 2009 and 2008.

Goodwill and licenses must be assessed for impairment annually or more frequently if events or changes

in circumstances indicate that such assets might be impaired.

The impairment test for goodwill is a two-step process. The first step compares the fair value of the

reporting unit as identified to its carrying value. If the carrying amount exceeds the fair value, the second

step of the test is performed to measure the amount of impairment loss, if any. The second step

compares the implied fair value of reporting unit goodwill with the carrying amount of that goodwill. To

calculate the implied fair value of goodwill in this second step, an enterprise allocates the fair value of

the reporting unit to all of the assets and liabilities of that reporting unit (including any unrecognized

intangible assets) as if the reporting unit had been acquired in a business combination and the fair value

was the price paid to acquire the reporting unit. The excess of the fair value of the reporting unit over the

amount assigned to the assets and liabilities of the reporting unit represents the implied fair value of

goodwill. If the carrying amount of goodwill exceeds the implied fair value of goodwill, an impairment

loss is recognized for that difference.

20