US Cellular 2009 Annual Report Download - page 15

Download and view the complete annual report

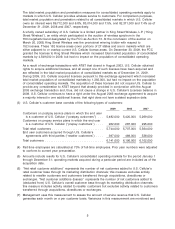

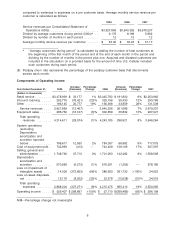

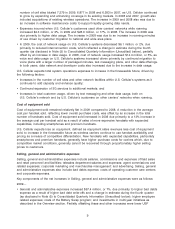

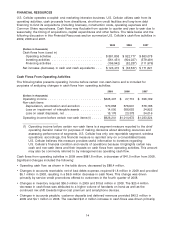

Please find page 15 of the 2009 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Operating Revenues

Service revenues

Service revenues consist primarily of: (i) charges for access, airtime, roaming, recovery of regulatory

costs and value-added services, including data products and services and long distance, provided to

U.S. Cellular’s retail customers and to end users through third-party resellers (‘‘retail service’’);

(ii) charges to other wireless carriers whose customers use U.S. Cellular’s wireless systems when

roaming, including long-distance roaming (‘‘inbound roaming’’); and (iii) amounts received from the

Federal Universal Service Fund (‘‘USF’’).

Retail service revenues

The increase in Retail service revenues in 2009 was due primarily to an increase in average monthly

retail service revenue per customer. The increase in 2008 was due primarily to growth in U.S. Cellular’s

average customer base and an increase in average monthly retail service revenue per customer.

The average number of customers in 2009 was relatively flat compared to 2008. The increase in the

average number of customers in 2008 was driven primarily by the net retail customer additions that

U.S. Cellular generated from its marketing distribution channels and by the timing of acquisitions.

Average monthly retail service revenue per customer increased 1% to $46.94 in 2009 from $46.55 in

2008, and increased 3% in 2008 from $45.25 in 2007. The increase in average monthly retail service

revenue was driven primarily by growth in revenues from data products and services.

Revenues from data products and services totaled $683.0 million in 2009, $511.7 million in 2008, and

$367.9 million in 2007 and represented 17% of total service revenues in 2009 compared to 13% and 10%

of total service revenues in 2008 and 2007, respectively. Such growth, which positively impacted average

monthly retail service revenue per customer, reflected customers’ continued and increasing usage of

U.S. Cellular’s text, picture, and video messaging services, easyedgeSM service and applications,

premium mobile Internet services, and smartphone handsets and services. In 2009, U.S. Cellular

introduced unlimited messaging plans and unlimited messaging and mobile Internet plans that further

drove data usage and revenues. U.S. Cellular expects that the growth in revenues from data products

and services will continue as customers increasingly purchase premium and smartphone devices along

with data plans and applications and utilize U.S. Cellular’s 3G network. U.S. Cellular’s 3G network

covered approximately 75% of its customers as of December 31, 2009. U.S. Cellular expects to expand

its 3G network to cover approximately 98% of its customers by the end of 2010.

Revenues from voice services declined year-over-year primarily due to a reduction in average voice

revenue per customer. The reduction in average voice revenue per customer reflects industry competition

which has resulted in lower pricing for voice services as well as growth in family plans and service plans

with enhanced coverage areas and value (such as free incoming calls, free mobile-to-mobile and

unlimited minutes). Also, decreases in the prepay customer base and the average revenue per prepay

customer contributed to a decline in prepay voice revenues. U.S. Cellular expects continued pressure on

revenues from voice services in the foreseeable future due to industry competition related to service plan

offerings.

Inbound roaming revenues

The decrease in Inbound roaming revenues in 2009 was due primarily to a decline in roaming revenues

from the combined entity of Verizon Wireless (‘‘Verizon’’) and Alltel Corporation (‘‘Alltel’’). In

January 2009, Verizon acquired Alltel. As a result of this transaction, the network footprints of Verizon

and Alltel were combined. This has resulted in a decrease in inbound roaming revenues for U.S. Cellular,

since the combined Verizon and Alltel entity has reduced its usage of U.S. Cellular’s network in certain

coverage areas that were used by Verizon and Alltel (as separate entities). U.S. Cellular anticipates that

inbound roaming revenues will stabilize in 2010 compared to 2009 due to the positive impact of

increasing minutes of use and increasing data usage from U.S. Cellular’s roaming partners, partially

offset by the negative impact of decreasing rates per minute or kilobyte of use.

7