US Cellular 2009 Annual Report Download - page 18

Download and view the complete annual report

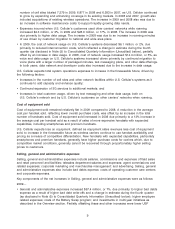

Please find page 18 of the 2009 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.contributions (most of the USF contribution expenses are offset by revenues for amounts passed

through to customers).

• Advertising expenses decreased $18.3 million, or 7%. Advertising expenses in 2008 included

expenditures related to the launch in June 2008 of a new branding campaign, Believe in Something

Betterᓼ.

• Other selling and marketing expenses increased $8.6 million, or 2%, reflecting higher commissions due

to a greater number of retail sales and renewals.

2008—

• General and administrative expenses increased $63.3 million, or 8%, due to increases in employee

related expenses; increases related to bad debts expense (reflecting both higher revenues and higher

bad debts as a percent of revenues); and increases in USF contributions and other regulatory fees

and taxes. Partially offsetting these expenses were decreases in consulting and outsourcing expenses

and billing expenses.

• Advertising expenses increased $47.3 million, or 21%, due primarily to an increase in media

purchases, including expenditures related to the launch in June 2008 of a new branding campaign,

Believe in Something Betterᓼ.

• Other selling and marketing expenses increased $31.9 million, or 6%, reflecting more retail sales

associates, higher retail facilities expenses and higher commissions due to a greater number of retail

sales and renewals.

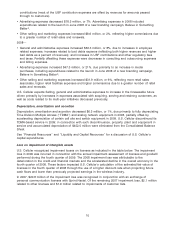

U.S. Cellular expects Selling, general and administrative expenses to increase in the foreseeable future

driven primarily by increases in expenses associated with acquiring, serving and retaining customers, as

well as costs related to its multi-year initiatives discussed previously.

Depreciation, amortization and accretion

Depreciation, amortization and accretion decreased $6.3 million, or 1%, due primarily to fully depreciating

Time Division Multiple Access (‘‘TDMA’’) and analog network equipment in 2008, partially offset by

accelerating depreciation of certain cell site and switch equipment in 2009. U.S. Cellular discontinued its

TDMA-based service in 2009; in connection with such discontinuance, property, plant and equipment in

service and accumulated depreciation of $452.0 million were eliminated from the Consolidated Balance

Sheet.

See ‘‘Financial Resources’’ and ‘‘Liquidity and Capital Resources’’ for a discussion of U.S. Cellular’s

capital expenditures.

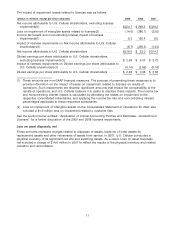

Loss on impairment of intangible assets

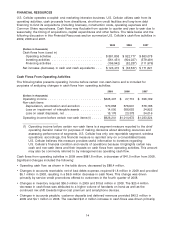

U.S. Cellular recognized impairment losses on licenses as indicated in the table below. The impairment

loss in 2009 was incurred in connection with the annual impairment assessment of licenses and goodwill

performed during the fourth quarter of 2009. The 2008 impairment loss was attributable to the

deterioration in the credit and financial markets and the accelerated decline in the overall economy in the

fourth quarter of 2008. These factors impacted U.S. Cellular’s calculation of the estimated fair value of

licenses in the fourth quarter of 2008 through the use of a higher discount rate when projecting future

cash flows and lower than previously projected earnings in the wireless industry.

In 2007, $20.8 million of the impairment loss was recognized in conjunction with an exchange of

personal communication licenses with Sprint Nextel. Of the remaining 2007 impairment loss, $2.1 million

related to other licenses and $1.9 million related to impairments of customer lists.

10