US Cellular 2009 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2009 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

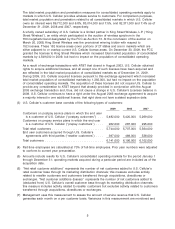

The total market population and penetration measures for consolidated operating markets apply to

markets in which U.S. Cellular provides wireless service to customers. For comparison purposes,

total market population and penetration related to all consolidated markets in which U.S. Cellular

owns an interest were 89,712,000 and 6.8%, 83,014,000 and 7.5%, and 82,371,000 and 7.4% as of

December 31, 2009, 2008 and 2007, respectively.

A wholly owned subsidiary of U.S. Cellular is a limited partner in King Street Wireless, L.P. (‘‘King

Street Wireless’’), an entity which participated in the auction of wireless spectrum in the

700 megahertz band designated by the FCC as Auction 73. At the conclusion of the auction on

March 20, 2008, King Street Wireless was the provisional winning bidder with respect to

152 licenses. These 152 license areas cover portions of 27 states and are in markets which are

either adjacent to or overlap current U.S. Cellular license areas. On December 30, 2009, the FCC

granted the licenses to King Street Wireless which increased total market population of consolidated

markets by 4,549,000 in 2009, but had no impact on the population of consolidated operating

markets.

As a result of exchange transactions with AT&T that closed in August 2003, U.S. Cellular obtained

rights to acquire additional licenses, and all except one of such licenses have been acquired and

are reflected in the total market population of consolidated markets as of December 31, 2009.

During 2009, U.S. Cellular acquired licenses pursuant to this exchange agreement which increased

total market population of consolidated markets by 1,392,000, but had no impact on the population

of consolidated operating markets. The acquisition of these licenses did not require U.S. Cellular to

provide any consideration to AT&T beyond that already provided in conjunction with the August

2003 exchange transaction and, thus, did not cause a change in U.S. Cellular’s Licenses balance in

2009. U.S. Cellular continues to have a right under the August 2003 exchange agreement to acquire

a majority interest in one additional license; that right does not have a stated expiration date.

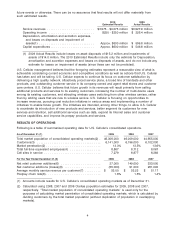

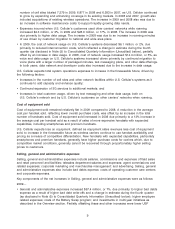

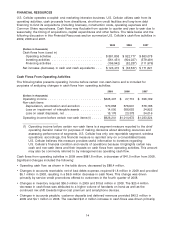

(3) U.S. Cellular’s customer base consists of the following types of customers:

2009 2008 2007

Customers on postpay service plans in which the end user

is a customer of U.S. Cellular (‘‘postpay customers’’) . . . 5,482,000 5,420,000 5,269,000

Customers on prepay service plans in which the end user

is a customer of U.S. Cellular (‘‘prepay customers’’) .... 262,000 287,000 295,000

Total retail customers ............................ 5,744,000 5,707,000 5,564,000

End user customers acquired through U.S. Cellular’s

agreements with third parties (‘‘reseller customers’’) .... 397,000 489,000 538,000

Total customers ................................ 6,141,000 6,196,000 6,102,000

(4) Part-time employees are calculated at 70% of full-time employees. Prior year numbers were adjusted

to conform to current year presentation.

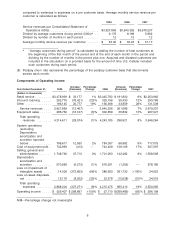

(5) Amounts include results for U.S. Cellular’s consolidated operating markets for the period January 1

through December 31; operating markets acquired during a particular period are included as of the

acquisition date.

(6) ‘‘Net retail customer additions’’ represents the number of net customers added to U.S. Cellular’s

retail customer base through its marketing distribution channels; this measure excludes activity

related to reseller customers and customers transferred through acquisitions, divestitures or

exchanges. ‘‘Net customer additions (losses)’’ represents the number of net customers added to

(deducted from) U.S. Cellular’s overall customer base through its marketing distribution channels;

this measure includes activity related to reseller customers but excludes activity related to customers

transferred through acquisitions, divestitures or exchanges.

(7) Management uses this measurement to assess the amount of service revenue that U.S. Cellular

generates each month on a per customer basis. Variances in this measurement are monitored and

5