US Cellular 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 5 INCOME TAXES (Continued)

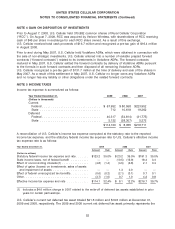

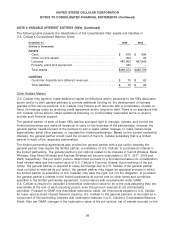

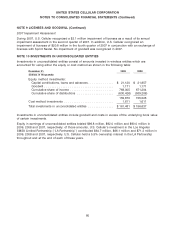

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

(Dollars in thousands) 2009 2008 2007

Balance at January 1, ...................................... $27,786 $33,890 $25,751

Additions for tax positions of current year ...................... 4,966 4,858 6,213

Additions for tax positions of prior years ....................... 3,114 692 2,793

Reductions for tax positions of prior years ...................... (1,399) (5,320) (491)

Reductions for settlements of tax positions ..................... — (3,177) (117)

Reductions for lapses in statutes of limitations ................... (25) (3,157) (259)

Balance at December 31, ................................... $34,442 $27,786 $33,890

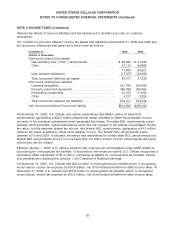

Unrecognized tax benefits are included in Accrued taxes and Other deferred liabilities and credits in the

Consolidated Balance Sheet.

As of December 31, 2009, U.S. Cellular believes it is reasonably possible that unrecognized tax benefits

could change significantly in the next twelve months. The nature of the uncertainty primarily relates to the

exclusion of certain transactions from certain state income taxes due primarily to anticipated closure of

state income tax audits and the expiration of statutes of limitation. It is anticipated that these events

could reduce unrecognized tax benefits in the range of $0.2 million to $8.7 million.

U.S. Cellular recognizes accrued interest and penalties related to unrecognized tax benefits in income tax

expense. The amounts charged to income tax expense totaled $2.1 million, $4.4 million and $2.0 million

in 2009, 2008 and 2007, respectively. Accrued interest and penalties were $15.7 million and $13.2 million

at December 31, 2009 and 2008, respectively.

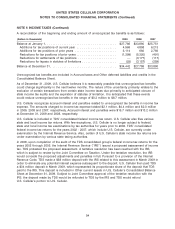

U.S. Cellular is included in TDS’ consolidated federal income tax return. U.S. Cellular also files various

state and local income tax returns. With few exceptions, U.S. Cellular is no longer subject to federal,

state and local income tax examinations by tax authorities for years prior to 2002. TDS’ consolidated

federal income tax returns for the years 2002 - 2007, which include U.S. Cellular, are currently under

examination by the Internal Revenue Service. Also, certain of U.S. Cellular’s state income tax returns are

under examination by various state taxing authorities.

In 2008, upon completion of the audit of the TDS consolidated group’s federal income tax returns for the

years 2002 through 2005, the Internal Revenue Service (‘‘IRS’’) issued a proposed assessment of income

tax. TDS protested the proposed assessment. A tentative resolution has been reached with the IRS,

which is subject to review by the Joint Committee on Taxation. Under the tentative resolution, the IRS

would concede the proposed adjustments and penalties in full. Pursuant to a provision of the Internal

Revenue Code, TDS made a $38 million deposit with the IRS related to this assessment in March 2009 in

order to eliminate any potential interest expense subsequent to the deposit. U.S. Cellular then paid TDS

a $34 million deposit in March 2009, which represented its proportionate share of the deposit that TDS

paid to the IRS. This deposit is included in Other current assets in U.S. Cellular’s Consolidated Balance

Sheet at December 31, 2009. Subject to Joint Committee approval of the tentative resolution with the

IRS, the deposit made by TDS would be refunded to TDS by the IRS and TDS would refund

U.S. Cellular’s portion to U.S. Cellular.

54