US Cellular 2009 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2009 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 2 NONCONTROLLING INTERESTS

Noncontrolling Interests Accounting

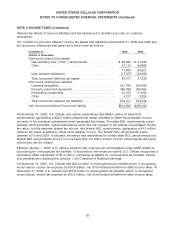

Effective January 1, 2009, U.S. Cellular adopted new required provisions under GAAP related to the

accounting and reporting for noncontrolling interests.

Pursuant to this adoption, the following provisions were applied retrospectively to all periods presented

in these financial statements:

• U.S. Cellular reclassified noncontrolling interests, formerly known as ‘‘minority interests,’’ from a

separate caption between liabilities and equity (‘‘mezzanine section’’) to a component of equity, with

the exception of noncontrolling interests with redemption features, which continue to require

mezzanine section presentation. Previously, minority interests generally were reported in the balance

sheet in the mezzanine section.

• Consolidated net income and comprehensive income include amounts attributable to both

U.S. Cellular and the noncontrolling interests. Previously, net income attributable to the noncontrolling

interests was reported as a deduction in arriving at consolidated net income. This presentation change

does not impact the calculation of basic or diluted earnings per share, which continue to be calculated

based on Net income attributable to U.S. Cellular.

• Shares of U.S. Cellular held by its subsidiary are reflected as treasury shares in the consolidated

financial statements. Previously, these shares were not reflected as issued shares and treasury shares

in the consolidated financial statements. As a result, 22,534 Common Shares were added to both

Common Shares issued and Treasury Shares in the Consolidated Balance Sheet as of December 31,

2009 and December 31, 2008.

Pursuant to this adoption, the following provisions were applied prospectively effective January 1, 2009:

• All earnings and losses of a subsidiary are attributed to the parent and the noncontrolling interest,

even if the losses attributable to the noncontrolling interest result in a deficit noncontrolling interest

balance. Previously, any losses exceeding the noncontrolling interest’s investment in the subsidiary

were attributed to the parent. This change did not have a significant impact on U.S. Cellular’s financial

statements in 2009.

• Once control of a subsidiary is obtained, changes in ownership interests in that subsidiary that do not

result in a loss of control are accounted for as equity transactions. Previously, decreases in ownership

interest in a subsidiary were accounted for as equity transactions, while increases in ownership

interests of a subsidiary were accounted for as step acquisitions. U.S. Cellular did not enter into any

transactions in 2009 that changed its ownership interest in its consolidated subsidiaries. During 2008,

U.S. Cellular purchased noncontrolling interests in a consolidated subsidiary. U.S. Cellular accounted

for this transaction as a step acquisition. The amounts recorded in this transaction are reflected in the

changes in the balances of Licenses, Goodwill and Customer lists.

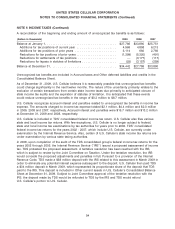

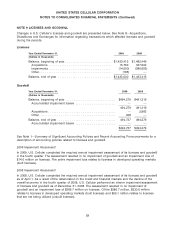

Mandatorily Redeemable Noncontrolling Interests in Finite-Lived Subsidiaries

Under GAAP, certain noncontrolling interests in consolidated entities with finite lives may meet the

definition of mandatorily redeemable financial instruments. U.S. Cellular’s consolidated financial

statements include certain noncontrolling interests that meet this definition of mandatorily redeemable

financial instruments. These mandatorily redeemable noncontrolling interests represent interests held by

third parties in consolidated partnerships and limited liability companies (‘‘LLCs’’), where the terms of the

underlying partnership or LLC agreement provide for a defined termination date at which time the assets

of the subsidiary are to be sold, the liabilities are to be extinguished and the remaining net proceeds are

to be distributed to the noncontrolling interest holders and U.S. Cellular in accordance with the

49