US Cellular 2009 Annual Report Download - page 50

Download and view the complete annual report

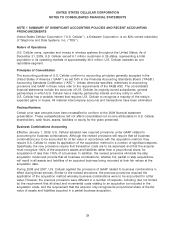

Please find page 50 of the 2009 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND RECENT ACCOUNTING

PRONOUNCEMENTS (Continued)

petition to deny the renewal application, the license will be renewed if the licensee can demonstrate its

entitlement to a ‘‘renewal expectancy.’’ Licensees are entitled to such an expectancy if they can

demonstrate to the FCC that they have provided ‘‘substantial service’’ during their license term and

have ‘‘substantially complied’’ with FCC rules and policies. U.S. Cellular believes that it is probable that

its future license renewal applications will be granted.

Goodwill

U.S. Cellular has goodwill as a result of its acquisitions of wireless markets. Such goodwill represents the

excess of the total purchase price over the fair value of net assets acquired in these transactions.

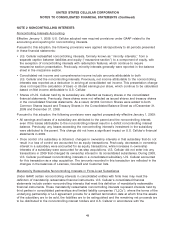

Goodwill and Licenses Impairment Assessment

Goodwill and licenses must be assessed for impairment annually or more frequently if events or changes

in circumstances indicate that such assets might be impaired.

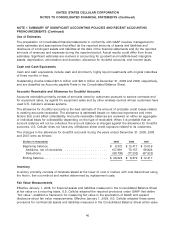

The impairment test for goodwill is a two-step process. The first step compares the fair value of the

reporting unit to its carrying value. If the carrying amount exceeds the fair value, the second step of the

test is performed to measure the amount of impairment loss, if any. The second step compares the

implied fair value of reporting unit goodwill with the carrying amount of that goodwill. To calculate the

implied fair value of goodwill in this second step, an enterprise allocates the fair value of the reporting

unit to all of the assets and liabilities of that reporting unit (including any unrecognized intangible assets)

as if the reporting unit had been acquired in a business combination and the fair value was the price

paid to acquire the reporting unit. The excess of the fair value of the reporting unit over the amount

assigned to the assets and liabilities of the reporting unit is the implied fair value of goodwill. If the

carrying amount of goodwill exceeds the implied fair value of goodwill, an impairment loss is recognized

for that difference.

The impairment test for an intangible asset other than goodwill consists of comparing the fair value of

the intangible asset to its carrying amount. If the carrying amount exceeds the fair value, an impairment

loss is recognized for the difference.

Quoted market prices in active markets are the best evidence of fair value of an intangible asset or

reporting unit and are used when available. If quoted market prices are not available, the estimate of fair

value is based on the best information available, including prices for similar assets and the use of other

valuation techniques. Other valuation techniques include present value analysis, multiples of earnings or

revenues, or similar performance measures. The use of these techniques involve assumptions by

management about factors that are uncertain including future cash flows, the appropriate discount rate,

and other inputs. Different assumptions for these inputs could create materially different results.

Historically, U.S. Cellular completed the required annual impairment assessment of its licenses and

goodwill as of April 1 of each year. As a result of the deterioration in the credit and financial markets and

the decline of the overall economy in the fourth quarter of 2008, U.S. Cellular performed an interim

impairment assessment of licenses and goodwill as of December 31, 2008. Effective April 1, 2009,

U.S. Cellular adopted a new accounting policy whereby its annual impairment review of goodwill and

indefinite-lived intangible assets will be performed as of November 1 instead of the second quarter of

each year. The change in the annual goodwill and indefinite-lived intangible asset impairment testing

date was made to better align the annual impairment test with the timing of U.S. Cellular’s annual

strategic planning process, which allows for a better estimate of the future cash flows used in discounted

cash flow models to test for impairment. This change in accounting policy does not delay, accelerate or

42