US Cellular 2009 Annual Report Download - page 10

Download and view the complete annual report

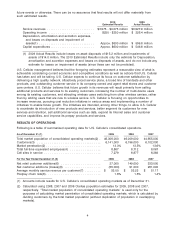

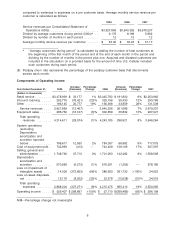

Please find page 10 of the 2009 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.redeemed at a redemption price equal to 100% of the principal amount plus accrued and unpaid

interest, which resulted in a total redemption payment of $131.7 million.

• Additions to property, plant and equipment totaled $546.8 million, including expenditures to construct

cell sites, increase capacity in existing cell sites and switches, expand mobile broadband services

based on third generation Evolution-Data Optimized technology (‘‘3G’’) to additional markets, outfit

new and remodel existing retail stores and continue the development and enhancement of

U.S. Cellular’s office systems. Total cell sites in service increased 6% year-over-year to 7,279.

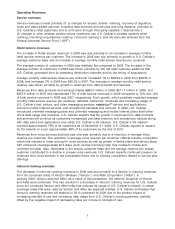

• As part of its customer satisfaction strategy and Believe in Something Betterᓼ brand message,

U.S. Cellular launched its Battery Swap program in May 2009. Under this new program, a customer

can exchange a battery that is dead or dying for one that is fully charged, at no cost to the customer.

U.S. Cellular was the first wireless company to offer this service in the United States, and completed

over one million battery swaps in 2009.

• In November 2009, U.S. Cellular launched Overage Protection, a customer satisfaction strategy that

allows customers to opt into receiving alerts when they come close to reaching their allowable plan

minutes or text messages for the month in order to avoid overage charges. Approximately 600,000 of

U.S. Cellular’s customers signed up for this service in 2009.

• U.S. Cellular began efforts on a number of multi-year initiatives including the development of: a Billing

and Operational Support System (‘‘BSS/OSS’’) including a new point-of-sale system to consolidate

billing on one platform; an Electronic Data Warehouse/Customer Relationship Management System to

collect and analyze information more efficiently to build and improve customer relationships; and a

new Internet/Web platform to enable customers to complete a wide range of transactions and,

eventually, to manage their accounts online.

• U.S. Cellular recognized a loss on impairment of licenses of $14.0 million in 2009. In 2008, a loss on

impairment of $386.7 million was recognized.

• Operating income increased $298.7 million to $326.4 million in 2009 from $27.7 million in 2008. A

significant factor in the year-over-year increase was the impairment loss related to licenses in 2008.

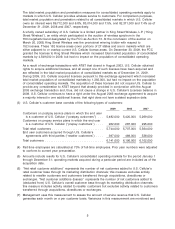

U.S. Cellular anticipates that future growth in its operating income will be affected by the following

factors:

– Overall demand for U.S. Cellular’s products and services, including potential growth in revenues

from data products and services;

– Increasing penetration in the wireless industry;

– Increased competition in the wireless industry, including potential reductions in pricing for products

and services overall and impacts associated with the expanding presence of carriers offering

low-priced, unlimited prepay service;

– Uncertainty related to current economic conditions and their impact on customer purchasing and

payment behaviors;

– Costs of customer acquisition and retention, such as equipment subsidies and advertising;

– Industry consolidation and the resultant effects on roaming revenues, service and equipment pricing

and other effects of competition;

– Providing service in recently launched areas or potential new market areas;

– Potential increases or decreases in prepay and reseller customers as a percentage of U.S. Cellular’s

customer base;

– Costs of developing and introducing new products and services;

– Costs of developing and enhancing office and customer support systems, including costs and risks

associated with the completion of important multi-year initiatives such as those described above;

2