US Cellular 2009 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2009 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

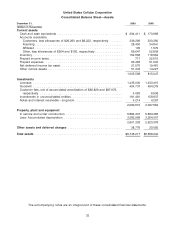

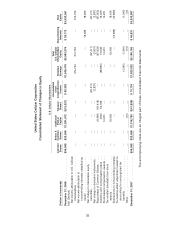

United States Cellular Corporation

Consolidated Statement of Changes in Equity

U.S. Cellular Shareholders

Accumulated Total

Series A Additional Other U.S. Cellular

Common Common Paid-In Treasury Comprehensive Retained Shareholders’ Noncontrolling Total

(Dollars in thousands) Shares Shares Capital Shares Income Earnings Equity Interests Equity

December 31, 2006 .............. $55,068 $33,006 $1,291,572 $(15,227) $ 80,382 $1,548,478 $2,993,279 $ 38,772 $3,032,051

Add (Deduct)

Net income attributable to U.S. Cellular

shareholders ................ — — — — — 314,734 314,734 — 314,734

Net income attributable to

noncontrolling interests classified as

equity ..................... — — — — — — — 18,925 18,925

Net change in marketable equity

securities ................... — — — — (67,411) — (67,411) — (67,411)

Net change in derivative instruments . . — — — — (2,837) — (2,837) — (2,837)

Repurchase of Common Shares ..... — — (6,484) (81,418) — — (87,902) — (87,902)

Incentive and compensation plans . . . — — (930) 54,786 — (38,850) 15,006 — 15,006

Stock-based compensation awards . . . — — 14,231 — — — 14,231 — 14,231

Tax windfall (shortfall) from stock

awards .................... — — 18,406 — — — 18,406 — 18,406

Distributions to noncontrolling interests — — — — — — — (10,866) (10,866)

Cumulative-effect adjustment related to

accounting for unrecognized tax

benefits .................... — — — — — (1,340) (1,340) — (1,340)

Other ....................... — — (10) — — — (10) — (10)

December 31, 2007 .............. $55,068 $33,006 $1,316,785 $(41,859) $ 10,134 $1,823,022 $3,196,156 $ 46,831 $3,242,987

The accompanying notes are an integral part of these consolidated financial statements.