US Cellular 2009 Annual Report Download - page 49

Download and view the complete annual report

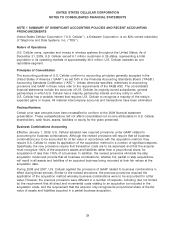

Please find page 49 of the 2009 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND RECENT ACCOUNTING

PRONOUNCEMENTS (Continued)

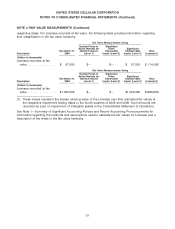

on a nonrecurring basis, and for amounts that are presented only in disclosures. The provisions do not

expand the use of fair value measurements in financial statements, but standardize their definition and

application in GAAP. The provisions provide that fair value is a market-based measurement and not an

entity-specific measurement, based on an exchange transaction in which the entity sells an asset or

transfers a liability (exit price). The provisions establish a fair value hierarchy that contains three levels for

inputs used in fair value measurements. Level 1 inputs include quoted market prices for identical assets

or liabilities in active markets. Level 2 inputs include quoted market prices for similar assets and liabilities

in active markets or quoted market prices for identical assets and liabilities in inactive markets. Level 3

inputs are unobservable.

Derivative Financial Instruments

U.S. Cellular does not hold or issue derivative financial instruments for trading purposes. U.S. Cellular

has in the past used derivative financial instruments to reduce risks related to fluctuations in market price

of its Vodafone Group Plc (‘‘Vodafone’’) American Depository Receipts (‘‘ADRs’’). U.S. Cellular had

variable prepaid forward contracts (‘‘forward contracts’’) in place with respect to all of its Vodafone

marketable equity securities for this purpose. These forward contracts matured in 2007. A substantial

majority of the related Vodafone ADRs were delivered upon settlement of the forward contracts upon

maturity. The remaining Vodafone ADRs were sold in 2007.

U.S. Cellular recognized all of the forward contracts as either assets or liabilities in the Consolidated

Balance Sheet and measured those instruments at their fair values. U.S. Cellular originally designated the

embedded collars within the forward contracts as cash flow hedges of its Vodafone ADRs. Accordingly,

all changes in the fair value of the embedded collars were recorded in Accumulated other

comprehensive income, net of income taxes. Subsequently, upon contractual modifications to the terms

of the collars in September 2002, the embedded collars no longer qualified for hedge accounting

treatment and all changes in fair value of the collars from the time of the contractual modification to the

termination or settlement of the terms of the collars have been included in the Consolidated Statement of

Operations.

Licenses

Licenses consist of costs incurred in acquiring Federal Communications Commission (‘‘FCC’’) licenses to

provide wireless service. These costs include amounts paid to license applicants and owners of interests

in entities awarded licenses and all direct and incremental costs related to acquiring the licenses.

U.S. Cellular has determined that wireless licenses are indefinite-lived intangible assets and, therefore,

not subject to amortization based on the following factors:

• Radio spectrum is not a depleting asset.

• The ability to use radio spectrum is not limited to any one technology.

• U.S. Cellular and its consolidated subsidiaries are licensed to use radio spectrum through the FCC

licensing process, which enables licensees to utilize specified portions of the spectrum for the

provision of wireless service.

• U.S. Cellular and its consolidated subsidiaries are required to renew their FCC licenses every ten years

or, in some cases, every fifteen years. From the inception of U.S. Cellular to date, all of U.S. Cellular’s

license renewal applications have been granted by the FCC. Generally, license renewal applications

filed by licensees otherwise in compliance with FCC regulations are routinely granted. If, however, a

license renewal application is challenged either by a competing applicant for the license or by a

41