US Cellular 2009 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2009 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

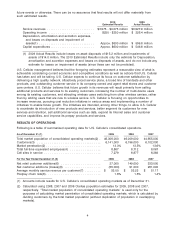

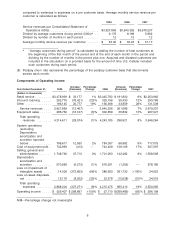

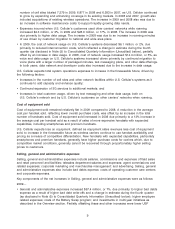

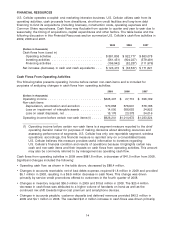

compared to variances in expenses on a per customer basis. Average monthly service revenue per

customer is calculated as follows

2009 2008 2007

Service revenues per Consolidated Statement of

Operations (000s) .......................... $3,927,859 $3,940,326 $3,679,237

Divided by average customers during period (000s)* . . 6,176 6,169 5,992

Divided by number of months in each period ........ 12 12 12

Average monthly service revenue per customer ...... $ 53.00 $ 53.23 $ 51.17

* ‘‘Average customers during period’’ is calculated by adding the number of total customers at

the beginning of the first month of the period and at the end of each month in the period and

dividing by the number of months in the period plus one. Acquired and divested customers are

included in the calculation on a prorated basis for the amount of time U.S. Cellular included

such customers during each period.

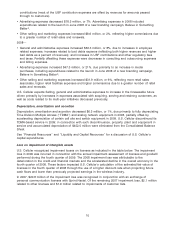

(8) Postpay churn rate represents the percentage of the postpay customer base that disconnects

service each month.

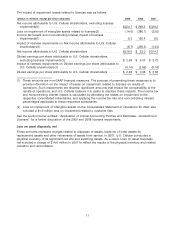

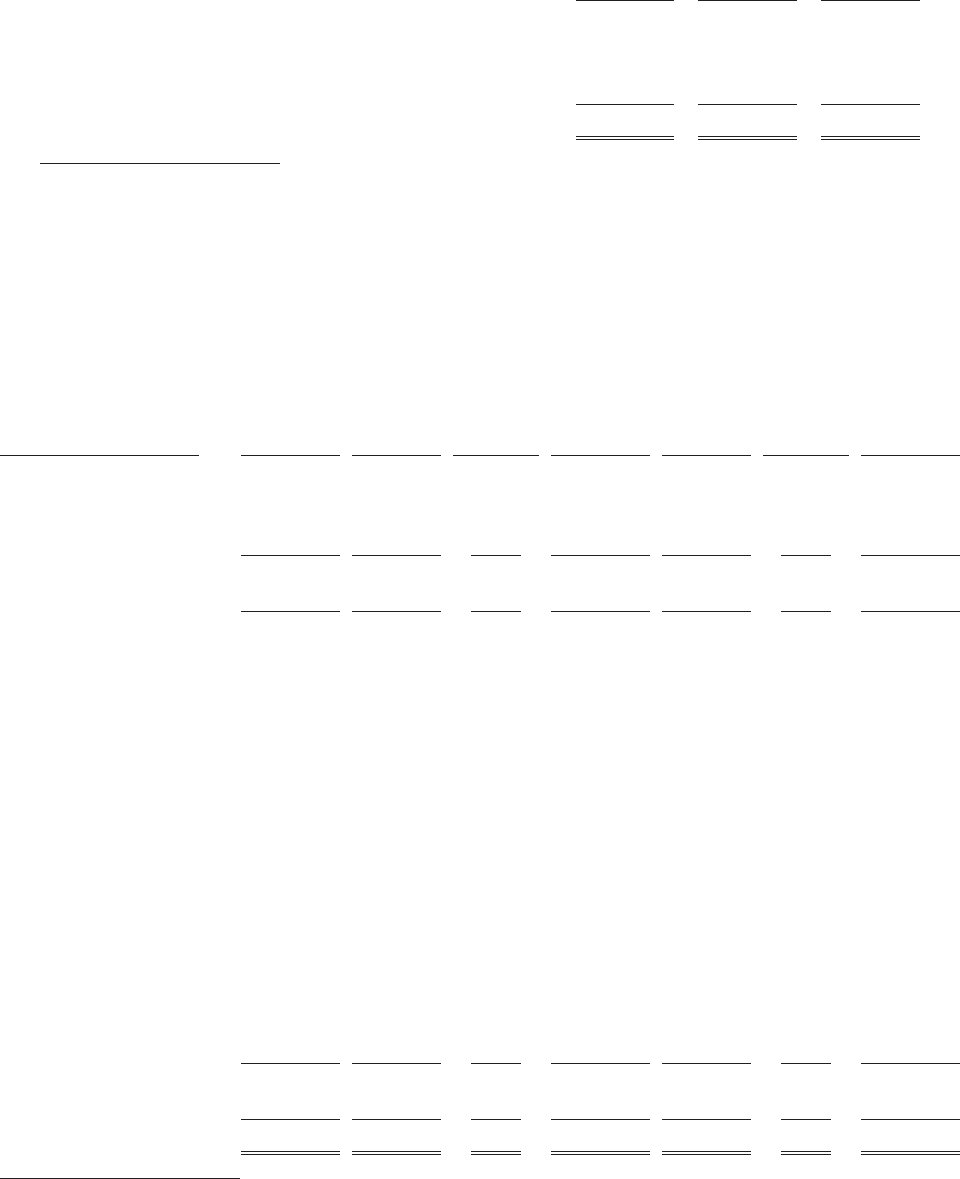

Components of Operating Income

Increase/ Percentage Increase/ Percentage

Year Ended December 31, 2009 (Decrease) Change 2008 (Decrease) Change 2007

(Dollars in thousands)

Retail service ......... $3,478,939 $ 33,177 1% $3,445,762 $ 191,800 6% $3,253,962

Inbound roaming ...... 252,775 (76,421) (23)% 329,196 35,430 12% 293,766

Other .............. 196,145 30,777 19% 165,368 33,859 26% 131,509

Service revenues .... 3,927,859 (12,467) — 3,940,326 261,089 7% 3,679,237

Equipment sales ...... 286,752 (16,107) (5)% 302,859 35,832 13% 267,027

Total operating

revenues ........ 4,214,611 (28,574) (1)% 4,243,185 296,921 8% 3,946,264

System operations

(excluding

Depreciation,

amortization and

accretion reported

below) ............ 796,617 12,560 2% 784,057 66,982 9% 717,075

Cost of equipment sold . 742,993 (413) — 743,406 106,109 17% 637,297

Selling, general and

administrative ....... 1,748,760 47,710 3% 1,701,050 142,482 9% 1,558,568

Depreciation,

amortization and

accretion .......... 570,658 (6,273) (1)% 576,931 (1,255) — 578,186

Loss on impairment of

intangible assets .... 14,000 (372,653) (96)% 386,653 361,730 >100% 24,923

Loss on asset disposals,

net .............. 15,176 (8,202) (35)% 23,378 (10,638) (31)% 34,016

Total operating

expenses ........ 3,888,204 (327,271) (8)% 4,215,475 665,410 19% 3,550,065

Operating income ..... $ 326,407 $ 298,697 >100% $ 27,710 $(368,489) (93)% $ 396,199

N/M—Percentage change not meaningful

6