US Cellular 2009 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2009 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

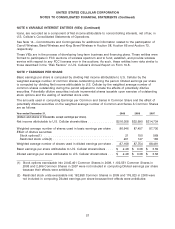

NOTE 7 EARNINGS PER SHARE (Continued)

During 2007, U.S. Cellular purchased Common Shares from an investment banking firm in private

accelerated share repurchase transactions (‘‘ASRs’’). The 2007 weighted average number of shares used

in computing Diluted earnings per share does not include the impact of unsettled ASRs at December 31,

2007 because the effects were antidilutive.

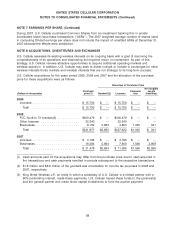

NOTE 8 ACQUISITIONS, DIVESTITURES AND EXCHANGES

U.S. Cellular assesses its existing wireless interests on an ongoing basis with a goal of improving the

competitiveness of its operations and maximizing its long-term return on investment. As part of this

strategy, U.S. Cellular reviews attractive opportunities to acquire additional operating markets and

wireless spectrum. In addition, U.S. Cellular may seek to divest outright or include in exchanges for other

wireless interests those markets and wireless interests that are not strategic to its long-term success.

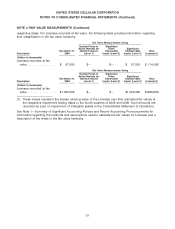

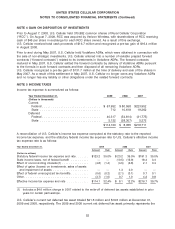

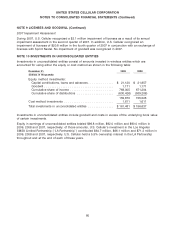

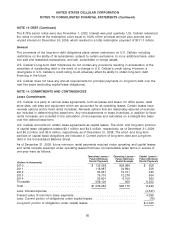

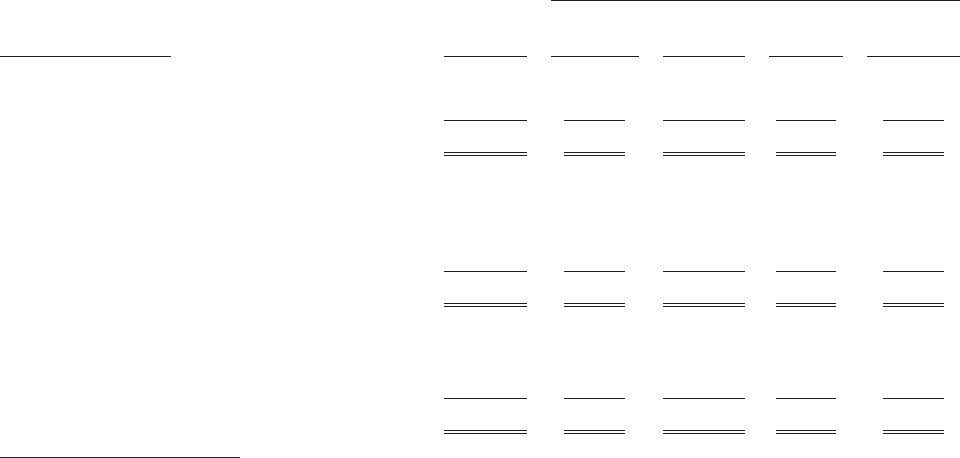

U.S. Cellular acquisitions for the years ended 2009, 2008 and 2007 and the allocation of the purchase

price for these acquisitions were as follows:

Allocation of Purchase Price

Net tangible

Purchase Customer assets

(Dollars in thousands) price(1) Goodwill(2) Licenses lists (liabilities)

2009

Licenses .......................... $ 15,750 $ — $ 15,750 $ — $ —

Total ........................... $ 15,750 $ — $ 15,750 $ — $ —

2008

FCC Auction 73 licenses(3) ............ $300,479 $ — $300,479 $ — $ —

Other licenses ..................... 32,340 — 32,340 — —

Businesses ........................ 9,152 2,963 4,803 1,045 341

Total ........................... $341,971 $2,963 $337,622 $1,045 $ 341

2007

Licenses .......................... $ 3,195 $ — $ 3,195 $ — $ —

Businesses ........................ 18,283 5,864 7,900 1,560 2,959

Total ........................... $ 21,478 $5,864 $ 11,095 $1,560 $2,959

(1) Cash amounts paid for the acquisitions may differ from the purchase price due to cash acquired in

the transactions and cash payments remitted in periods subsequent to the respective transactions.

(2) $1.6 million and $5.9 million of the goodwill was amortizable for income tax purposes in 2008 and

2007, respectively.

(3) King Street Wireless L.P., an entity in which a subsidiary of U.S. Cellular is a limited partner with a

90% partnership interest, made these payments. U.S. Cellular loaned these funds to the partnership

and the general partner and made direct capital investments to fund the auction payment.

58