US Cellular 2009 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2009 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

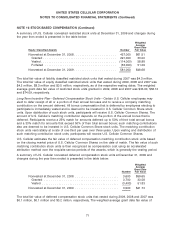

NOTE 15 COMMON SHAREHOLDERS’ EQUITY (Continued)

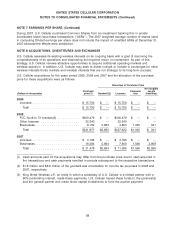

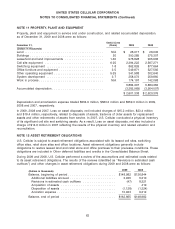

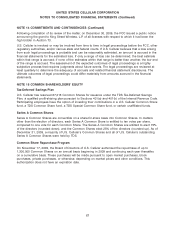

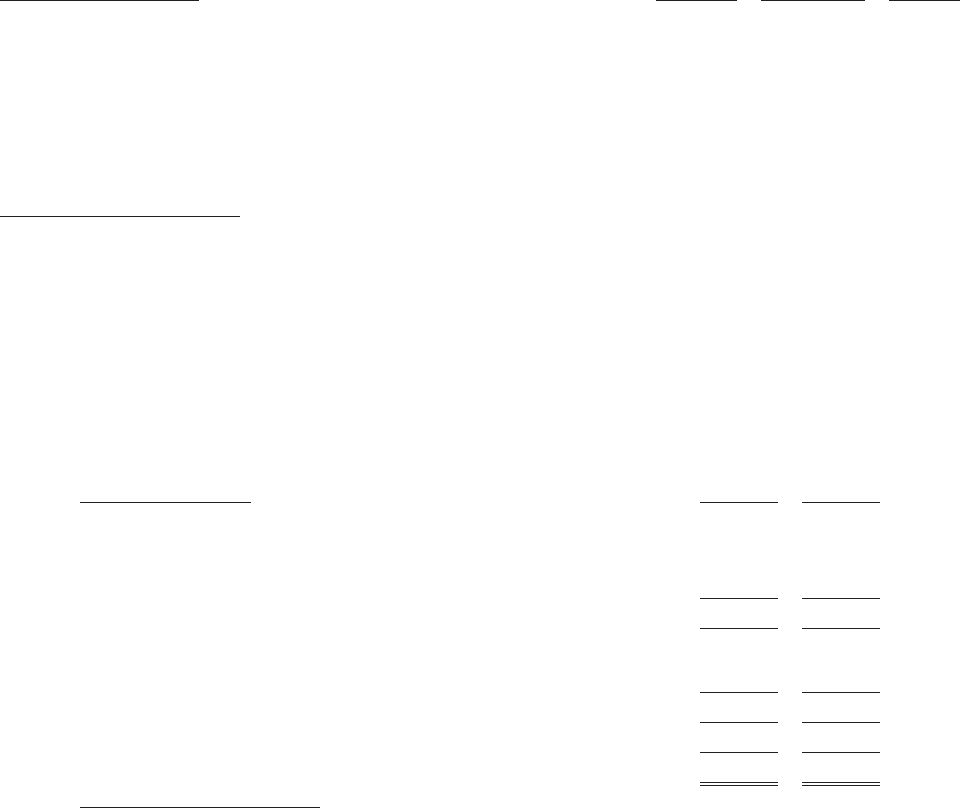

Share repurchases made under this authorization and prior authorizations, were as follows:

Number of Average Cost

Year Ended December 31, Shares Per Share Amount

(Dollars and share amounts in thousands)

2009

U.S. Cellular Common Shares ........................... 887 $37.86 $33,585

2008

U.S. Cellular Common Shares ........................... 600 $54.87 $32,920

2007

U.S. Cellular Common Shares

purchased through ASR transactions(1) ................... 1,006 $82.85 $83,348

(1) U.S. Cellular received $4.6 million in 2008 as a final cash settlement of Common Share repurchases

executed in 2007 through an accelerated share repurchase transactions with an investment banking

firm.

Pursuant to certain employee and non-employee benefit plans, U.S. Cellular reissued 147,414, 283,567

and 880,647 Treasury Shares in 2009, 2008 and 2007, respectively.

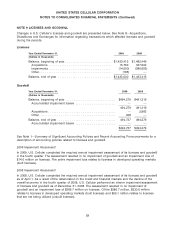

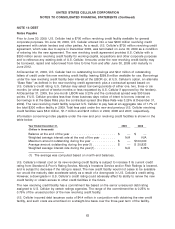

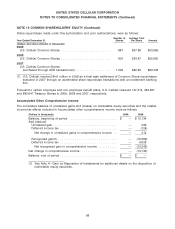

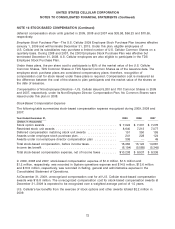

Accumulated Other Comprehensive Income

The cumulative balance of unrealized gains and (losses) on marketable equity securities and the related

income tax effects included in Accumulated other comprehensive income were as follows:

(Dollars in thousands) 2009 2008

Balance, beginning of period .......................... $ — $10,134

Add (deduct):

Unrealized gain ................................... — 338

Deferred income tax ............................... — (124)

Net change in unrealized gains in comprehensive income . . — 214

Recognized gain(1) ................................ — (16,356)

Deferred income tax ............................... — 6,008

Net recognized gain in comprehensive income .......... — (10,348)

Net change in comprehensive income .................... — (10,134)

Balance, end of period ............................... $ — $ —

(1) See Note 4—Gain on Disposition of Investments for additional details on the disposition of

marketable equity securities.

68