US Cellular 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

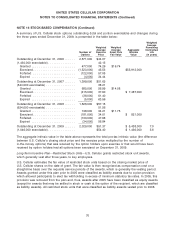

NOTE 16 STOCK-BASED COMPENSATION (Continued)

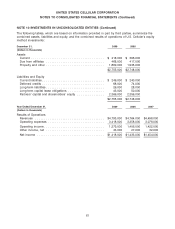

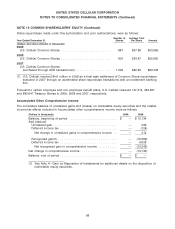

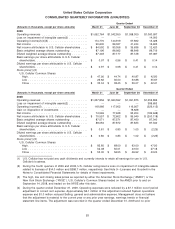

A summary of U.S. Cellular nonvested restricted stock units at December 31, 2009 and changes during

the year then ended is presented in the table below:

Weighted

Average

Grant Date

Equity Classified Awards Number Fair Value

Nonvested at December 31, 2008 ....................... 457,000 $61.51

Granted ........................................ 291,000 33.00

Vested ......................................... (114,000) 58.88

Forfeited ....................................... (53,000) 51.29

Nonvested at December 31, 2009 ....................... 581,000 $48.68

The total fair value of liability classified restricted stock units that vested during 2007 was $4.3 million.

The total fair value of equity classified restricted stock units that vested during 2009, 2008 and 2007 was

$4.2 million, $8.3 million and $0.5 million, respectively, as of the respective vesting dates. The weighted

average grant date fair value of restricted stock units granted in 2009, 2008 and 2007 was $33.00, $56.12

and $74.09, respectively.

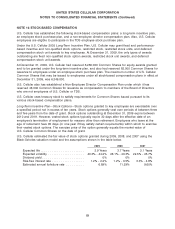

Long-Term Incentive Plan—Deferred Compensation Stock Units—Certain U.S. Cellular employees may

elect to defer receipt of all or a portion of their annual bonuses and to receive a company matching

contribution on the amount deferred. All bonus compensation that is deferred by employees electing to

participate is immediately vested and is deemed to be invested in U.S. Cellular Common Share stock

units. Upon distribution of such stock units, participants will receive U.S. Cellular Common Shares. The

amount of U.S. Cellular’s matching contribution depends on the portion of the annual bonus that is

deferred. Participants receive a 25% match for amounts deferred up to 50% of their total annual bonus

and a 33% match for amounts that exceed 50% of their total annual bonus; such matching contributions

also are deemed to be invested in U.S. Cellular Common Share stock units. The matching contribution

stock units vest ratably at a rate of one-third per year over three years. Upon vesting and distribution of

such matching contribution stock units, participants will receive U.S. Cellular Common Shares.

U.S. Cellular estimates the fair value of deferred compensation matching contribution stock units based

on the closing market price of U.S. Cellular Common Shares on the date of match. The fair value of such

matching contribution stock units is then recognized as compensation cost using an accelerated

attribution method over the requisite service periods of the awards, which is generally the vesting period.

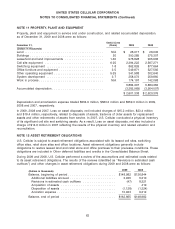

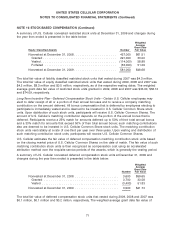

A summary of U.S. Cellular nonvested deferred compensation stock units at December 31, 2009 and

changes during the year then ended is presented in the table below:

Weighted

Average

Grant Date

Number Fair Value

Nonvested at December 31, 2008 ........................ 3,600 $59.65

Granted ......................................... 3,700 33.58

Vested .......................................... (3,400) 51.83

Nonvested at December 31, 2009 ........................ 3,900 $41.73

The total fair value of deferred compensation stock units that vested during 2009, 2008 and 2007 was

$0.1 million, $0.1 million and $0.2 million, respectively. The weighted average grant date fair value of

71