US Cellular 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 4 GAIN ON DISPOSITION OF INVESTMENTS

Prior to August 7, 2008, U.S. Cellular held 370,882 common shares of Rural Cellular Corporation

(‘‘RCC’’). On August 7, 2008, RCC was acquired by Verizon Wireless, with shareholders of RCC receiving

cash of $45 per share in exchange for each RCC share owned. As a result of this exchange,

U.S. Cellular received total cash proceeds of $16.7 million and recognized a pre-tax gain of $16.4 million

in August 2008.

Prior to and during May 2007, U.S. Cellular held Vodafone ADRs, which were obtained in connection with

the sale of non-strategic investments. U.S. Cellular entered into a number of variable prepaid forward

contracts (‘‘forward contracts’’) related to its investments in Vodafone ADRs. The forward contracts

matured in May 2007. U.S. Cellular settled the forward contracts by delivery of Vodafone ADRs pursuant

to the formula in such forward contracts and then disposed of all remaining Vodafone ADRs.

U.S. Cellular recognized a pre-tax gain of $131.7 million at the time of delivery and sale of the shares in

May 2007. As a result of this settlement in May 2007, U.S. Cellular no longer owns any Vodafone ADRs

and no longer has any liability or other obligations under the related forward contracts.

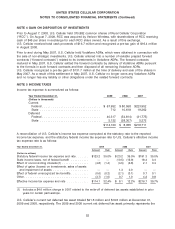

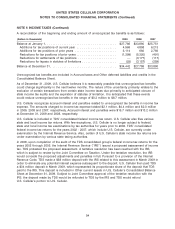

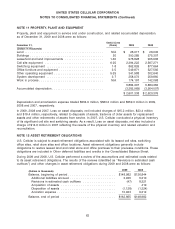

NOTE 5 INCOME TAXES

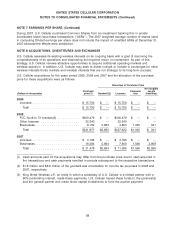

Income tax expense is summarized as follows:

Year Ended December 31, 2009 2008 2007

(Dollars in thousands)

Current

Federal ................................ $ 67,952 $ 80,558 $223,952

State ................................. 712 10,618 19,262

Deferred

Federal ................................ 40,317 (54,814) (31,775)

State ................................. 5,122 (28,307) 5,272

$114,103 $ 8,055 $216,711

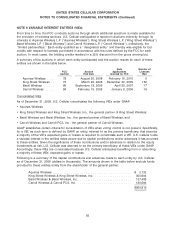

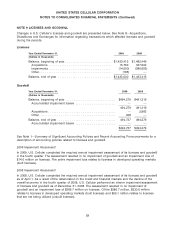

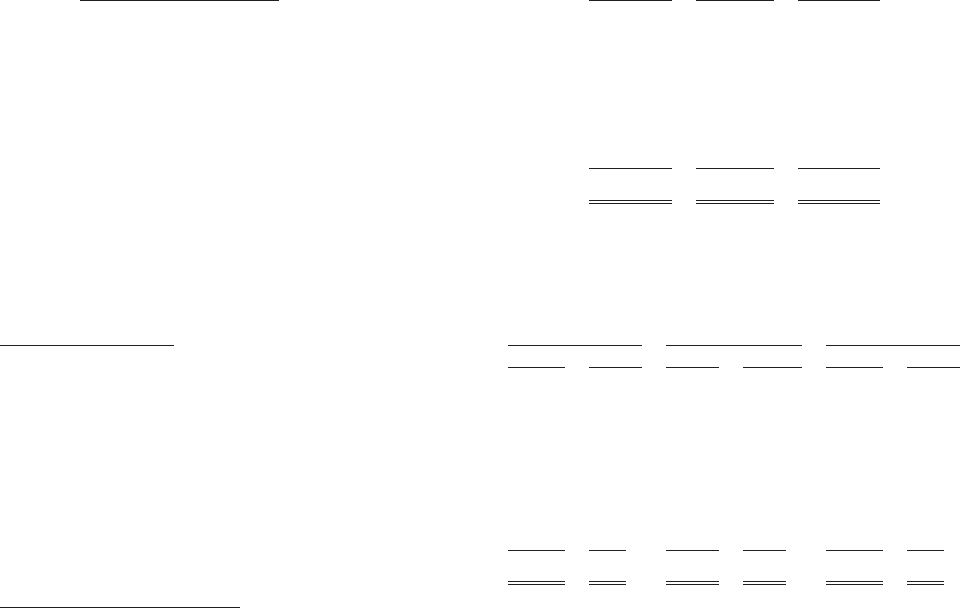

A reconciliation of U.S. Cellular’s income tax expense computed at the statutory rate to the reported

income tax expense, and the statutory federal income tax expense rate to U.S. Cellular’s effective income

tax expense rate is as follows:

Year Ended December 31, 2009 2008 2007

Amount Rate Amount Rate Amount Rate

(Dollars in millions)

Statutory federal income tax expense and rate ....... $123.2 35.0% $ 23.2 35.0% $191.3 35.0%

State income taxes, net of federal benefit .......... — — (10.5) (15.9) 18.4 3.4

Effect of noncontrolling interests(1) ............... (4.8) (1.4) (4.5) (6.8) 2.1 0.4

Effect of gains (losses) on investments, sales of assets

and impairment of assets .................... — — 1.3 2.0 — —

Effect of federal unrecognized tax benefits .......... (0.6) (0.2) (2.1) (3.1) 0.7 0.1

Other .................................... (3.7) (1.0) 0.7 1.0 4.2 0.8

Effective income tax expense and rate ............ $114.1 32.4% $ 8.1 12.2% $216.7 39.7%

(1) Includes a $4.6 million charge in 2007 related to the write-off of deferred tax assets established in prior

years for certain partnerships.

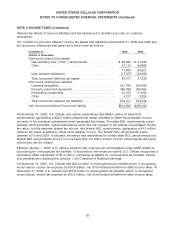

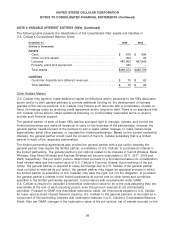

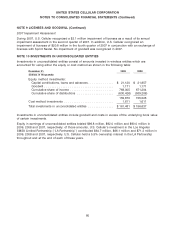

U.S. Cellular’s current net deferred tax asset totaled $21.6 million and $19.5 million at December 31,

2009 and 2008, respectively. The 2009 and 2008 current net deferred tax asset primarily represents the

52