U-Haul 2007 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2007 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

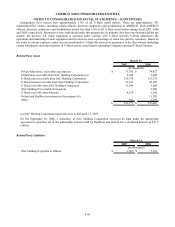

The discount rate assumptions in computing the information above were as follows:

2007 2006 2005

Accumulated postretirement benefit obligation 5.75% 5.75% 5.75%

Year Ended March 31,

(In percentages)

The discount rate represents the expected yield on a portfolio of high grade (AA to AAA rated or equivalent) fixed

income investments with cash flow streams sufficient to satisfy benefit obligations under the plan when due. Fluctuations in

the discount rate assumptions primarily reflect changes in U.S. interest rates. The estimated health care cost inflation rates

used to measure the accumulated post retirement benefit obligation was 6.50% in fiscal 2007, which was projected to

decline annually to an ultimate rate of 4.50% in fiscal 2014.

If the estimated health care cost inflation rate assumptions were increased by one percent, the accumulated post

retirement benefit obligation as of fiscal year-end would increase by approximately $209,127 and the total of the service

cost and interest cost components would increase by $41,789. A decrease in the estimated health care cost inflation rate

assumption of one percent would decrease the accumulated post retirement benefit obligation as of fiscal year-end by

$235,499 and the total of the service cost and interest cost components would decrease by $47,631.

Post employment benefits provided by the Company, other than retirement, are not material.

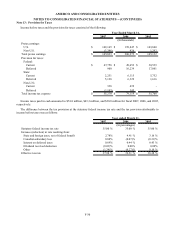

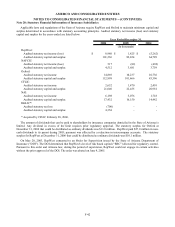

Future net benefit payments are expected as follows:

Amount

(In thousands)

Year-ended:

2008 $ 387

2009 443

2010 517

2011 586

2012 668

2013 through 2017 4,810

Total $ 7,411

F-34