U-Haul 2007 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2007 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

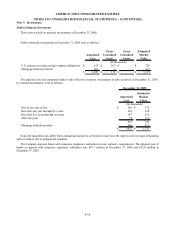

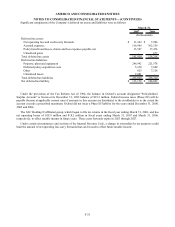

The hedging relationship of the interest rate swap agreements is not considered to be perfectly effective. Therefore, for

each reporting period an effectiveness test is performed. For the portion of the change in the interest rate swaps fair value

deemed effective, this is charged to accumulated other comprehensive income. The remaining ineffective portion is

charged to interest expense for the period. For the year ended March 31, 2007, the Company recorded $2.4 million to

interest income related to these swap agreements, all of which represented the ineffective component of the swap that

impacted earnings during the period.

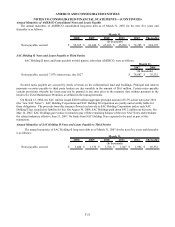

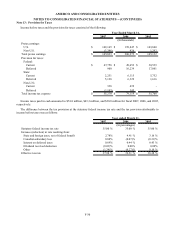

Interest Rates

Interest rates and Company borrowings were as follows:

2007 2006 2005

Weighted average interest rate during the year 6.76% 5.95% 5.69%

Interest rate at year end

-

6.45% 6.43%

Maximum amount outstanding during the yea

r

$ 90,000 $ 158,011 $ 164,051

Average amount outstanding during the year $ 70,027 $ 96,710 $ 46,771

Facility fees $ 300 $ - $ -

(In thousands, except interest rates)

Revolving Credit Activity

Year Ended March 31,

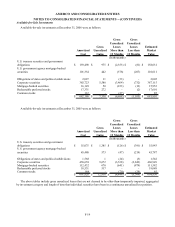

Note 11: Stockholders’ Equity

The Serial common stock may be issued in such series and on such terms as the Board shall determine. The Serial

preferred stock may be issued with or without par value. The 6,100,000 shares of Series A, no par, non-voting, 8½%

cumulative preferred stock that are issued and outstanding are not convertible into, or exchangeable for, shares of any other

class or classes of stock of AMERCO. Dividends on the Series A preferred stock are payable quarterly in arrears and have

priority as to dividends over the common stock of AMERCO.

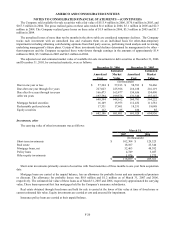

On September 13, 2006, the Company announced that its Board had authorized the Company to repurchase up to $50.0

million of its Common Stock. The stock may be repurchased by the Company from time to time on the open market

between September 13, 2006 and October 31, 2007. On March 9, 2007, the Board authorized an increase in the Company’ s

common stock repurchase program to a total aggregate amount, net of brokerage commissions, of $115.0 million (which

amount is inclusive of the $50.0 million common stock repurchase program approved by the Board in 2006). As with the

original program, the Company may repurchase stock from time to time on the open market until October 31, 2007. The

extent to which the Company repurchases its shares and the timing of such purchases will depend upon market conditions

and other corporate considerations. The purchases will be funded from available working capital. During the fourth quarter

of fiscal 2007, the Company repurchased 739,291 shares.

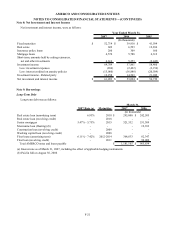

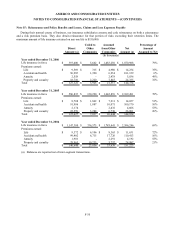

The repurchases made by the Company were as follows:

Period

January 1 - 31, 2007 - - - - 50,000,000

February 1 - 28, 2007 268,653 68.37$ 268,653 18,368,840$ 31,631,160$

March 1 - 31, 2007 (2) 470,638 65.31$ 470,638 30,737,262$ 65,893,898$

Fourth Quarter Total 739,291 66.42$ 739,291 49,106,102$

(1) Represents weighted average purchase price for the periods represented.

Maximum $ of

Shares That May Yet

be Repurchased

Under the Plan

(2) On March 9, 2007, the Board authorized an increase in the Company's common stock repurchase program to a total aggregate

amount, net of brokerage commissions, of $115.0 million (which amount is inclusive of the $50.0 million common stock

repurchase program approved by the Board in 2006).

Total # of Shares

Repurchased

Average

Price Paid

per Share (1)

Total # of Shares

Repurchased as Part

of Publicly

Announced Plan

Total $ of Shares

Repurchased as Part

of Publicly

Announced Plan

F-28