U-Haul 2007 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2007 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

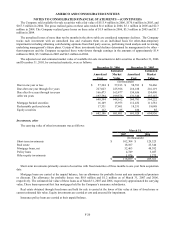

U-Haul International, Inc. and several of its subsidiaries are borrowers under an amortizing term loan. The lender is

Bayerische Hypo-und Vereinsbank AG (“HVB”). The Company’ s outstanding balance at March 31, 2007 was $43.3

million and its final maturity is July 2013.

The HVB Rental Truck Amortizing Loan requires monthly principal and interest payments, with the unpaid loan

balance and accrued and unpaid interest due at maturity. The HVB Rental Truck Amortizing Loan was used to purchase

new trucks. The interest rate, per the provision of the Loan Agreement, is the applicable LIBOR plus a margin between

1.25% and 1.75%. At March 31, 2007 the applicable LIBOR was 5.32% and the applicable margin was 1.75%, the sum of

which was 7.07%. The interest rate is hedged with an interest rate swap fixing the rate at 7.42% based on the current

margin. U-Haul International, Inc. is a guarantor of this loan. The default provisions of the loan include non-payment of

principal or interest and other standard reporting and change-in-control covenants.

U-Haul International, Inc. and several of its subsidiaries are borrowers under an amortizing term loan. The lender is

U.S. Bancorp Equipment Finance, Inc. (“U.S. Bank”). The Company’ s outstanding balance at March 31, 2007 was $29.5

million and its final maturity is February 2014.

The U.S. Bank Rental Truck Amortizing Loan requires monthly principal and interest payments, with the unpaid loan

balance and accrued and unpaid interest due at maturity. The U.S. Bank Rental Truck Amortizing Loan was used to

purchase new trucks. The interest rate, per the provision of the Loan Agreement, is the applicable LIBOR plus a margin

between 0.900% and 1.125%. At March 31, 2007 the applicable LIBOR was 5.32% and the applicable margin was

1.125%, the sum of which was 6.45%. The interest rate is hedged with an interest rate swap fixing the rate at 6.37% based

on the current margin. AMERCO and U-Haul International, Inc. are guarantors of this loan. The default provisions of the

loan include non-payment of principal or interest and other standard reporting and change-in-control covenants.

U-Haul International, Inc. and several of its subsidiaries are borrowers under an amortizing term loan. The lenders are

HSBC Bank US, NA and KBC Bank, NV (“HSBC/KBC”). The Company’ s outstanding balance at March 31, 2007 was

$40.0 million and its final maturity is March 2014.

The HSBC/KBC Rental Truck Amortizing Loan requires monthly principal and interest payments, with the unpaid loan

balance and accrued and unpaid interest due at maturity. The HSBC/KBC Rental Truck Amortizing Loan was used to

purchase new trucks. The interest rate, per the provision of the Loan Agreement, is the applicable LIBOR plus a margin

between 0.900% and 1.125%. At March 31, 2007 the applicable LIBOR was 5.32% and the applicable margin was

1.125%, the sum of which was 6.45%. The interest rate is hedged with an interest rate swap fixing the rate at 6.11% based

on the current margin. AMERCO is a guarantor of this loan. The default provisions of the loan include non-payment of

principal or interest and other standard reporting and change-in-control covenants.

Revolving Credit Agreement

U-Haul International, Inc. and several of its subsidiaries are borrowers under a revolving credit facility. The lender is

Merrill Lynch Commercial Finance Corp. The original amount that could be drawn was $150.0 million with an original

maturity date of July 2010. On March 12, 2007, the revolving credit agreement was amended to limit the maximum amount

that can be drawn to $100.0 million and extended the final maturity to March 2011. As of March 31, 2007, there was no

balance outstanding on this revolving credit agreement.

The revolving credit agreement requires monthly interest payments, with the unpaid loan balance and accrued and

unpaid interest due at maturity. The revolving credit agreement is secured by various older rental trucks. The interest rate,

per the provision of the Loan Agreement, is the applicable LIBOR plus a margin of 1.37%.

F-24