U-Haul 2007 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2007 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

F

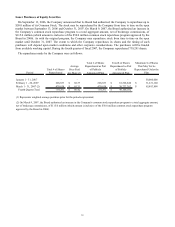

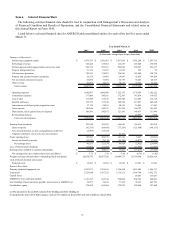

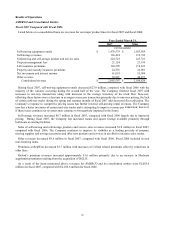

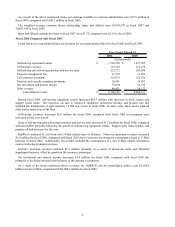

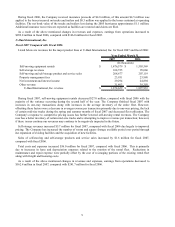

isted below on a consolidated basis are revenues for our major product lines for fiscal 2007 and fiscal 2006:

Results of Operations

AMERCO and Consolidated Entities

iscal 2007 Compared with Fiscal 2006

L

2007 2006

Self-moving equipment rentals $ 1,476,579 $ 1,503,569

Self-storage revenues 126,424 119,742

Self-moving and self-storage product and service sales 224,722 223,721

Property management fees 21,154 21,195

Life insurance premiums 120,399 118,833

Property and casualty insurance premiums 24,335 26,001

Net investment and interest income 61,093 53,094

Other revenue 30,891 40,471

Consolidated revenue $ 2,085,597 $ 2,106,626

(In thousands)

Year Ended March 31,

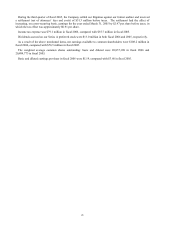

During fiscal 2007, self-moving equipment rentals decreased $27.0 million, compared with fiscal 2006 with the

majority of the variance occurring during the second half of the year. The Company finished fiscal 2007 with

increases in one-way transactions along with increases in the average inventory of the truck fleet. However,

offsetting these factors were a decrease in average revenue per transaction primarily due to one-way pricing, the lack

of certain mid-size trucks during the spring and summer months of fiscal 2007 and decreased fleet utilization. The

Company’ s response to competitive pricing issues has further lowered self-moving rental revenues. The Company

now has a better inventory of certain mid-size trucks and is attempting to improve revenue per transaction; however,

if

Company has increased rooms and square footage available primarily through

b

e,

m

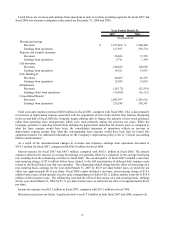

reased $9.6 million in fiscal 2007, compared with fiscal 2006. Fiscal 2006 included several

n

t RepWest decreased $1.7 million with increases in U-Haul related premiums offset by reductions in

ot

illion primarily due to an increase in Medicare

su

nd its consolidated entities were $2,085.6

million for fiscal 2007, compared with $2,106.6 million for fiscal 2006.

these issues continue our revenues may continue to be negatively impacted in the future.

Self-storage revenues increased $6.7 million in fiscal 2007, compared with fiscal 2006 largely due to improved

pricing. During fiscal 2007, the

uild-outs at existing facilities.

Sales of self-moving and self-storage products and service sales revenues increased $1.0 million in fiscal 2007,

compared with fiscal 2006. The Company continues to improve its visibility as a leading provider of propan

oving supplies and towing accessories and offer new products and services in an effort to increase sales results.

Other revenues dec

on-recurring items.

Premiums a

her lines.

Oxford’ s premium revenues increased approximately $1.6 m

pplement premiums resulting from the acquisition of DGLIC.

As a result of the items mentioned above, revenues for AMERCO a