U-Haul 2007 Annual Report Download - page 73

Download and view the complete annual report

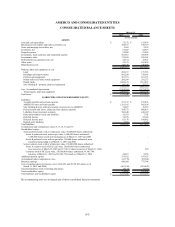

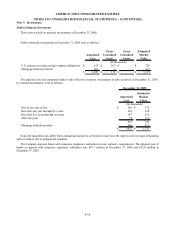

Please find page 73 of the 2007 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.AMERCO AND CONSOLIDATED ENTITIES

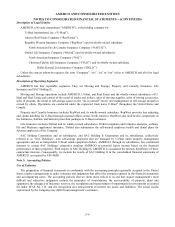

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 1: Basis of Presentation

AMERCO has a fiscal year that ends on the 31st of March for each year that is referenced. Our insurance company

subsidiaries have fiscal years that end on the 31st of December for each year that is referenced. They have been consolidated

on that basis. Our insurance companies’ financial reporting processes conform to calendar year reporting as required by

state insurance departments. Management believes that consolidating their calendar year into our fiscal year financial

statements does not materially affect the financial position or results of operations. The Company discloses any material

events occurring during the intervening period. Consequently, all references to our insurance subsidiaries’ years 2006, 2005

and 2004 correspond to fiscal 2007, 2006 and 2005 for AMERCO. The operating results and financial position of

AMERCO’ s consolidated insurance operations are determined as of December 31st of each year.

Accounts denominated in non-U.S. currencies have been re-measured into U.S. dollars. Certain amounts reported in

previous years have been reclassified to conform to the current presentation.

Note 2: Principles of Consolidation

The consolidated financial statements include the accounts of AMERCO, its wholly-owned subsidiaries and SAC

Holding II Corporation and its subsidiaries (“SAC Holding II”).

In fiscal 2003 and 2002, SAC Holding Corporation and SAC Holding II Corporation (collectively referred to as “SAC

Holdings”) were considered special purpose entities and were consolidated based on the provision of Emerging Issues Task

Force (EITF) Issue No. 90-15.

In fiscal 2004, the Company applied FIN 46(R) to its interests in SAC Holdings. In February 2004, SAC Holding

Corporation restructured the indebtedness of three subsidiaries and then distributed its interest in those subsidiaries to its

sole shareholder. This triggered a requirement to reassess AMERCO’ s involvement with those subsidiaries, which led to

the conclusion that based on the current contractual and ownership interests between AMERCO and this entity, AMERCO

ceased to have a variable interest in those three subsidiaries at that date.

In March 2004, SAC Holding Corporation restructured its indebtedness, triggering a similar reassessment of SAC

Holding Corporation that led to the conclusion that SAC Holding Corporation was not a VIE and that AMERCO ceased to

be the primary beneficiary of SAC Holding Corporation and its remaining subsidiaries. This conclusion was based on SAC

Holding Corporation’ s ability to fund its own operations and execute its business plan without any future subordinated

financial support.

Accordingly, at the dates AMERCO ceased to have a variable interest in or ceased to be the primary beneficiary of SAC

Holding Corporation and its current or former subsidiaries, it deconsolidated those entities. The deconsolidation was

accounted for as a distribution of SAC Holding Corporations interests to the sole shareholder of the SAC entities. Because

of AMERCO’ s continuing involvement with SAC Holding Corporation and its current and former subsidiaries, the

distributions do not qualify as discontinued operations as defined by SFAS No. 144.

It is possible that SAC Holding Corporation could take actions that would require us to re-determine whether SAC

Holding Corporation has become a VIE or whether we have become the primary beneficiary of SAC Holding Corporation.

Should this occur, we could be required to consolidate some or all of SAC Holding Corporation with our financial

statements.

Similarly, SAC Holding II could take actions that would require us to re-determine whether it is a VIE or whether we

continue to be the primary beneficiary of our variable interest in SAC Holding II. Should we cease to be the primary

beneficiary, we would be required to deconsolidate some or all of our variable interest in SAC Holding II from our financial

statements.

Intercompany accounts and transactions have been eliminated.

F-8