U-Haul 2007 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2007 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

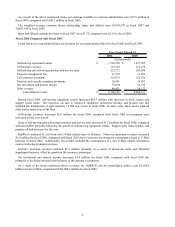

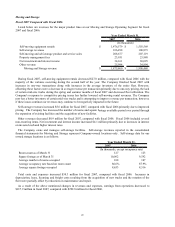

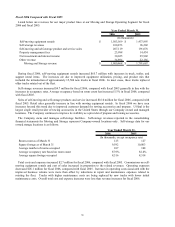

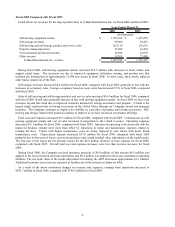

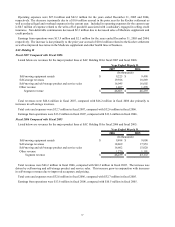

Fiscal 2006 Compared with Fiscal 2005

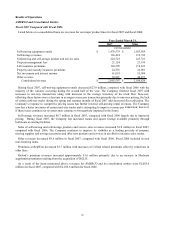

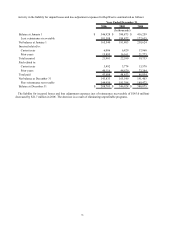

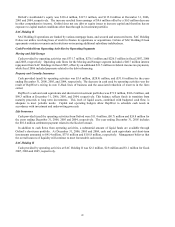

Listed below are revenues for the major product lines at U-Haul International, Inc. for fiscal 2006 and fiscal 2005:

2006 2005

Self-moving equipment rentals $ 1,503,569 $ 1,437,895

Self-storage revenues 99,060 94,431

Self-moving and self-storage product and service sales 207,119 191,078

Property management fees 23,988 14,434

Net investment and interest income 24,894 22,030

Other revenue 39,303 27,489

U-Haul International, Inc. revenue $ 1,897,933 $ 1,787,357

Year Ended March 31,

(In thousands)

ately 15,500 new trucks in fiscal 2006. In most cases, these trucks replaced

ol

ancy rates. Average occupancy based on room count has increased 5.5% in fiscal 2006, compared

w

s. Self-

m

ed with fiscal 2005. Overall total cost and expense increases were less than revenue increases for fiscal

2

ximates $1.1 million.

A

ngs from operations increased to

$241.7 million in fiscal 2006, compared with $140.5 million for fiscal 2005.

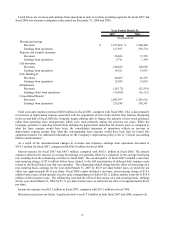

During fiscal 2006, self-moving equipment rentals increased $65.7 million with increases in truck, trailer, and

support rental items. The increases are due to improved equipment utilization, pricing, and product mix that

included the introduction of approxim

der trucks rotated out of the fleet.

Self-storage revenues increased $4.6 million for fiscal 2006, compared with fiscal 2005 generally in line with the

increases in occup

ith fiscal 2005.

Sales of self-moving and self-storage products and service sales increased $16.0 million for fiscal 2006, compared

with fiscal 2005. Retail sales generally increase in line with moving equipment rentals. In fiscal 2006 we have seen

increases beyond this trend due to improved customer demand for towing accessories and propane. U-Haul is the

largest single retail provider of towing accessories in the United States through our Company owned and managed

locations. The Company continues to improve its visibility as a provider of propane and towing accessorie

oving and storage related retail products continue to improve as we have increased our product offerings.

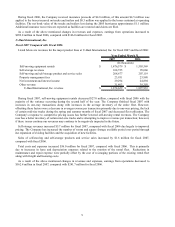

Total costs and expenses increased $9.3 million for fiscal 2006, compared with fiscal 2005. Commissions on self-

moving equipment rentals and cost of sales increased in proportion to the related revenues. Operating expenses

decreased $15.1 million for fiscal 2006, compared with fiscal 2005. Increases in operating costs associated with the

improved business volume were more than offset by reductions in repair and maintenance expenses related to

rotating the fleet. Trucks with higher maintenance costs are being replaced by new trucks with lower initial

maintenance costs. Depreciation expense increased $17.8 million for fiscal 2006, compared with fiscal 2005

primarily due to buy-outs of leases, new truck purchases and certain residual value adjustments on the rental trucks.

The buy-outs of the leases are the primary reason for the $8.6 million decrease in lease expense for fiscal 2006,

compar

006.

During fiscal 2006, the Company received insurance proceeds of $4.8 million, of this amount $4.5 million was

applied to the losses incurred on trucks and trailers and $0.3 million was applied to the losses sustained at operating

facilities. The net book value of the trucks and trailers lost during the 2005 hurricanes appro

dditional insurance recoveries are expected as facilities are fully restored as claims are filed.

As a result of the above mentioned changes in revenues and expenses, earni