U-Haul 2007 Annual Report Download - page 28

Download and view the complete annual report

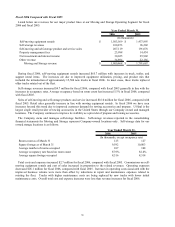

Please find page 28 of the 2007 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.AMERCO files a consolidated tax return with all of its legal subsidiaries, except for Dallas General Life Insurance

Company (“DGLIC”) which will file on a stand alone basis. SAC Holding Corporation and its legal subsidiaries

and SAC Holding II Corporation and its legal s

22

ubsidiaries file consolidated tax returns, which are in no way

A

recognized as a

co

easurement lag was $0.1 million, after tax. This

w

statement errors.

P

adjustment would not be material in any specific period and therefore

di

enses on sales - leaseback vehicle transactions to ensure that all new instances would be

accounted for properly.

associated with AMERCO’ s consolidated returns.

doption of New Accounting Pronouncements

In September 2006, the Financial Accounting Standards Board (FASB) issued SFAS 158, Employers’ Accounting

for Defined Benefit Pension and Other Post Retirement Plans – an amendment of SFAS 87, 88, 106 and 132(R),

which requires companies to recognize a net liability or asset to report the over-funded or under-funded status of

their defined benefit pension and other postretirement benefit plans on their balance sheets and recognize changes in

funded status in the year in which the changes occur through other comprehensive income. The funded status to be

measured is the difference between plan assets at fair value and the benefit obligation. This Statement requires that

gains and losses and prior service costs or credits, net of tax, that arise during the period be

mponent of other comprehensive income and not as components of net periodic benefit cost.

We adopted the balance sheet provisions of SFAS 158, as required, at March 31, 2007. As a result the Company

recorded after tax unrecognized losses of $0.2 million to accumulated other comprehensive income in fiscal 2007.

As discussed in Note 14 “Employee Benefit Plans” to the Consolidated Financial Statements, the Company

previously used December 31 as the measurement date to measure the assets and obligations of its post retirement

and post employment benefits plans. SFAS 158 requires the Company to perform the measurements at year end. The

portion of the net periodic cost associated with the three month m

as recorded as an adjustment to retained earnings in fiscal 2007.

In September 2006, the SEC issued Staff Accounting Bulletin (SAB) 108 “Considering the Effects of Prior Year

Misstatements in Current Year Financial Statements”, which provides interpretive guidance on how the effects of

prior year uncorrected misstatements should be considered when quantifying misstatements in current year financial

statements. There was diversity in practice, with the two commonly used methods to quantify misstatements being

the “rollover” method (which primarily focuses on the income statement impact of misstatements) and the “iron

curtain” method (which focuses on the cumulative amount by which the current year balance sheet is misstated and

may not prevent significant misstatements in the income statement). SAB 108 requires registrants to use a dual

approach whereby both of these methods are considered in evaluating the materiality of financial

rior materiality assessments were reconsidered using both the rollover and iron curtain methods.

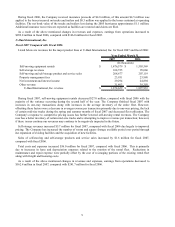

Effective March 31, 2007 the Company adopted SAB 108 and recorded a correction in the fourth quarter of fiscal

2007 related to prepaid expenses on leased equipment. In analyzing this error we determined that it was not material

to our statement of earnings in any single quarter or annual period; however, the cumulative adjustment necessary

would have been material in the current period. In accordance with SAB 108, the Company adjusted its beginning

retained earnings balance for fiscal 2007 and its financial results for the first three quarters of fiscal 2007 for this

adjustment. The Company determined that the

d not restate historical financial statements.

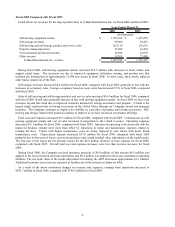

The error was related to rental equipment originally leased during periods between fiscal 2000 and fiscal 2002.

The rental equipment was sold to the lessor at less than its book value and then subsequently leased back to the

Company via an operating lease. The difference between the sales price to the lessor and the book value prior to the

sale was deferred and amortized over the life of the equipment. Per SFAS 28 the amortization period should have

been over the term of the lease. The Company quantified the error and in fiscal 2007 changed its accounting

treatment for prepaid exp