U-Haul 2007 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2007 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

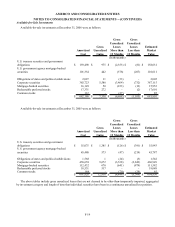

The Company sold available-for-sale securities with a fair value of $113.4 million in 2006, $170.6 million in 2005, and

$167.5 million in 2004. The gross realized gains on these sales totaled $1.6 million in 2006, $5.1 million in 2005 and $2.3

million in 2004. The Company realized gross losses on these sales of $1.9 million in 2006, $3.3 million in 2005 and $1.7

million in 2004.

The unrealized losses of more than twelve months in the above table are considered temporary declines. The Company

tracks each investment with an unrealized loss and evaluates them on an individual basis for other-than-temporary

impairments including obtaining corroborating opinions from third party sources, performing trend analysis and reviewing

underlying management’ s future plans. Certain of these investments had declines determined by management to be other -

than-temporary and the Company recognized these write-downs through earnings in the amounts of approximately $1.4

million in 2006, $5.3 million in 2005 and $4.3 million in 2004.

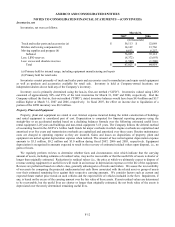

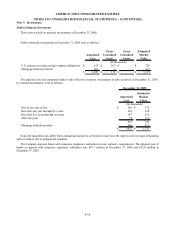

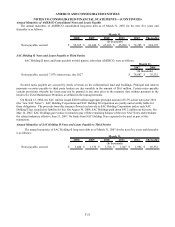

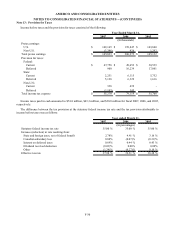

The adjusted cost and estimated market value of available-for-sale investments in debt securities at December 31, 2006

and December 31, 2005, by contractual maturity, were as follows:

Amortized

Cost

Estimated

Market

Value

Amortized

Cost

Estimated

Market

Value

Due in one year or less $ 57,304 $ 57,183 $ 58,593 $ 58,466

Due after one year through five years 227,023 225,926 216,188 216,119

Due after five years through ten years 166,473 165,477 154,656 154,490

After ten years 197,794 199,576 131,344 135,147

648,594 648,162 560,781 564,222

Mortgage backed securities 16,149 15,953 112,432 111,581

Redeemable preferred stocks 17,331 17,601 18,531 19,048

Equity securities 112 85 184 85

$ 682,186 $ 681,801 $ 691,928 $ 694,936

December 31, 2006 December 31, 2005

(In thousands)

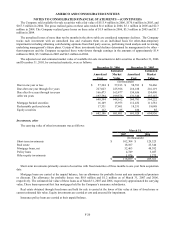

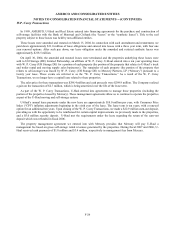

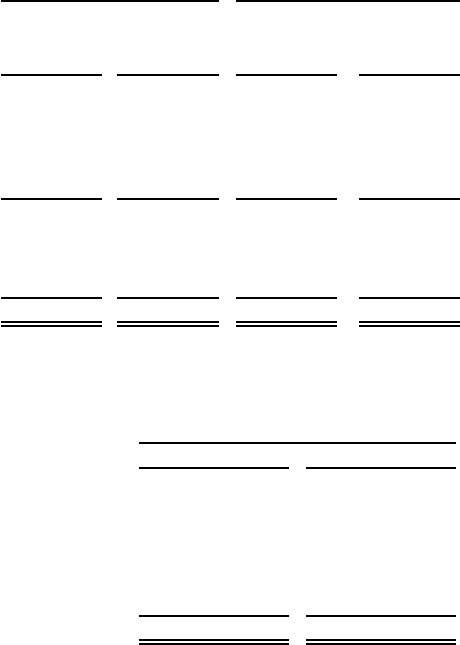

Investments, other

The carrying value of other investments was as follows:

2007 2006

Short-term investments $ 102,304 $ 129,325

Real estate 18,107 25,344

Mortgage loans, net 52,463 48,392

Policy loans 4,749 5,027

Other equity investments 1,076 1,273

$ 178,699 $ 209,361

March 31,

(In thousands)

Short-term investments primarily consist of securities with fixed maturities of three months to one year from acquisition

date.

Mortgage loans are carried at the unpaid balance, less an allowance for probable losses and any unamortized premium

or discount. The allowance for probable losses was $0.8 million and $1.2 million as of March 31, 2007 and 2006,

respectively. The estimated fair value of these loans as of March 31, 2007 and 2006, respectively approximated the carrying

value. These loans represent first lien mortgages held by the Company’ s insurance subsidiaries.

Real estate obtained through foreclosure and held for sale is carried at the lower of fair value at time of foreclosure or

current estimated fair value. Equity investments are carried at cost and assessed for impairment.

Insurance policy loans are carried at their unpaid balance.

F-20