U-Haul 2007 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2007 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

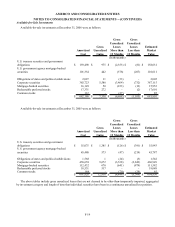

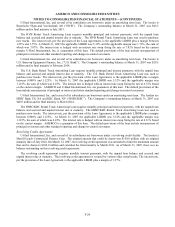

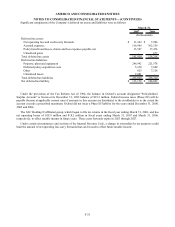

Annual Maturities of AMERCO Consolidated Notes and Loans Payable

The annual maturities of AMERCO consolidated long-term debt as of March 31, 2007 for the next five years and

thereafter is as follows:

2008 2009 2010 2011 2012 Thereafter

Notes payable, secured $ 92,335 $ 83,444 $ 63,033 $ 45,890 $ 72,285 $ 824,178

March 31,

(In thousands)

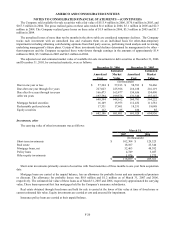

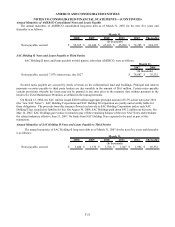

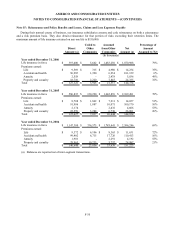

SAC Holding II Notes and Loans Payable to Third Parties

SAC Holding II notes and loans payable to third parties, other than AMERCO, were as follows:

2007 2006

Notes payable, secured, 7.87% interest rate, due 2027 $ 74,887 $ 76,232

(In thousands)

March 31,

Secured notes payable are secured by deeds of trusts on the collateralized land and buildings. Principal and interest

payments on notes payable to third party lenders are due monthly in the amount of $0.6 million. Certain notes payable

contain provisions whereby the loans may not be prepaid at any time prior to the maturity date without payment to the

lender of a Yield Maintenance Premium, as defined in the loan agreements.

On March 15, 2004, the SAC entities issued $200.0 million aggregate principal amount of 8.5% senior notes due 2014

(the “new SAC Notes”). SAC Holding Corporation and SAC Holding II Corporation are jointly and severally liable for

these obligations. The proceeds from this issuance flowed exclusively to SAC Holding Corporation and as such SAC

Holding II has recorded no liability for this. On August 30, 2004, SAC Holdings paid down $43.2 million on this note. On

May 16, 2007, SAC Holdings gave notice it intends to pay off the remaining balance of the new SAC Notes and terminate

the related indenture effective June 21, 2007. No funds from SAC Holding II are expected to be used as part of this

transaction.

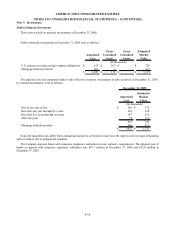

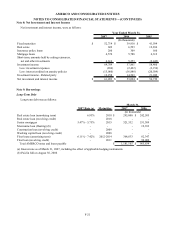

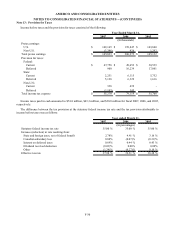

Annual Maturities of SAC Holding II Notes and Loans Payable to Third Parties

The annual maturities of SAC Holding II long-term debt as of March 31, 2007 for the next five years and thereafter

is as follows:

2008 2009 2010 2011 2012 Thereafter

Notes payable, secured $ 1,440 $ 1,576 $ 1,706 $ 1,847 $ 1,986 $ 66,332

March 31,

(In thousands)

F-25