U-Haul 2007 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2007 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

Note 18: Preferred Stock Purchase Rights

The Board of Directors of AMERCO adopted a stockholder-rights plan in July 1998. The rights were declared as a

dividend of one preferred share purchase right for each outstanding share of the common stock of AMERCO. The dividend

distribution was payable on August 17, 1998 to stockholders of record on that date. When exercisable, each right will

entitle its holder to purchase from AMERCO one one-hundredth of a share of AMERCO Series C Junior Participating

Preferred Stock (Series C), no par value, at a price of $132.00 per one one-hundredth of a share of Series C, subject to

adjustment. AMERCO has created a series of 3,000,000 shares of authorized but not issued preferred stock for the Series C

stock authorized in this stockholder-rights plan.

The rights will become exercisable if a person or group of affiliated or associated persons acquire or obtain the right to

acquire beneficial ownership of 10% or more of the common stock without approval of a majority of the Board of Directors

of AMERCO. The rights expire on August 7, 2008 unless earlier redeemed or exchanged by AMERCO.

In the event AMERCO is acquired in a merger or other business combination transaction after the rights become

exercisable, each holder of a right would be entitled to receive that number of shares of the acquiring company’ s common

stock equal to the result obtained by multiplying the then current purchase price by the number one one-hundredths of a

share of Series C for which a right is then exercisable and dividing that product by 50% of the then current market price per

share of the acquiring company.

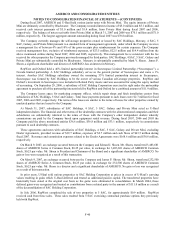

Note 19: Related Party Transactions

AMERCO has engaged in related party transactions and has continuing related party interests with certain major

stockholders, directors and officers of the consolidated group as disclosed below. Management believes that the

transactions described below and in the related notes were consummated on terms equivalent to those that would prevail in

arm’ s-length transactions.

SAC Holdings was established in order to acquire self-storage properties. These properties are being managed by the

Company pursuant to management agreements. The sale of self-storage properties by the Company to SAC Holdings has in

the past provided significant cash flows to the Company and certain of the Company’ s outstanding loans to SAC Holdings

entitle the Company to participate in SAC Holdings’ excess cash flows (after senior debt service).

Management believes that its sales of self-storage properties to SAC Holdings in the past provided a unique structure

for the Company to earn moving equipment rental revenues and property management fee revenues from the SAC Holdings

self-storage properties that the Company manages and to participate in SAC Holdings’ excess cash flows as described

above. To date, no excess cash flows relative to these arrangements have been earned or paid.

During fiscal 2007, subsidiaries of the Company held various junior unsecured notes of SAC Holdings. Substantially all

of the equity interest of SAC Holdings is controlled by Blackwater, wholly-owned by Mark V. Shoen, a significant

shareholder and executive officer of AMERCO. The Company does not have an equity ownership interest in SAC

Holdings. The Company recorded interest income of $19.2 million, $19.4 million and $22.0 million, and received cash

interest payments of $44.5 million, $11.2 million and $11.7 million, from SAC Holdings during fiscal 2007, 2006 and

2005, respectively. The cash interest payments for fiscal 2007 included a payment to significantly reduce the outstanding

interest receivable from SAC Holdings. The largest aggregate amount of notes receivable outstanding during fiscal 2007

and the aggregate notes receivable balance at March 31, 2007 and March 31, 2006 was $203.7 million, of which $75.1

million is with SAC Holding II and has been eliminated in the consolidated financial statements.

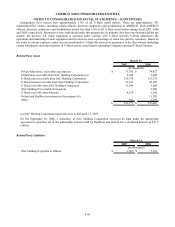

Interest accrues on the outstanding principal balance of junior notes of SAC Holdings that the Company holds at a

stated rate of basic interest. A fixed portion of that basic interest is paid on a monthly basis.

Additional interest can be earned on notes totaling $142.3 million of principal depending upon the amount of remaining

basic interest and the cash flow generated by the underlying property. This amount is referred to as the “cash flow-based

calculation.”

To the extent that this cash flow-based calculation exceeds the amount of remaining basic interest, contingent interest is

paid on the same monthly date as the fixed portion of basic interest. To the extent that the cash flow-based calculation is

less than the amount of remaining basic interest, the additional interest payable on the applicable monthly date is limited to

the amount of that cash flow-based calculation. In such a case, the excess of the remaining basic interest over the cash flow-

based calculation is deferred. In addition, subject to certain contingencies, the junior notes provide that the holder of the

note is entitled to receive a portion of the appreciation realized upon, among other things, the sale of such property by SAC

Holdings.

F-39