U-Haul 2007 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2007 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

L

fleet, rental equipment and storage space, working

ca

ebt and borrowing capacity, please see Note 9 “Borrowings” to the “Notes to

D

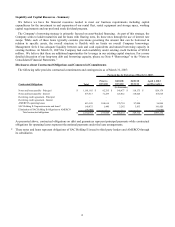

iquidity and Capital Resources - Summary

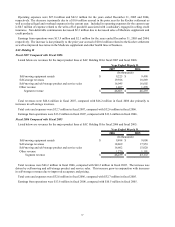

We believe we have the financial resources needed to meet our business requirements including capital

expenditures for the investment in and expansion of our rental

pital requirements and our preferred stock dividend program.

The Company’ s borrowing strategy is primarily focused on asset-backed financing. As part of this strategy, the

Company seeks to ladder maturities and for loans with floating rates, fix these rates through the use of interest rate

swaps. While each of these loans typically contains provisions governing the amount that can be borrowed in

relation to specific assets, the overall structure is flexible with no limits on overall Company borrowings.

Management feels it has adequate liquidity between cash and cash equivalents and unused borrowing capacity in

existing facilities. At March 31, 2007 the Company had cash availability under existing credit facilities of $360.0

million. We believe that there are additional opportunities for leverage in our existing capital structure. For a more

detailed discussion of our long-term d

Consolidated Financial Statements.”

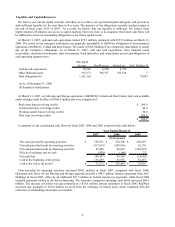

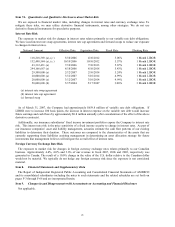

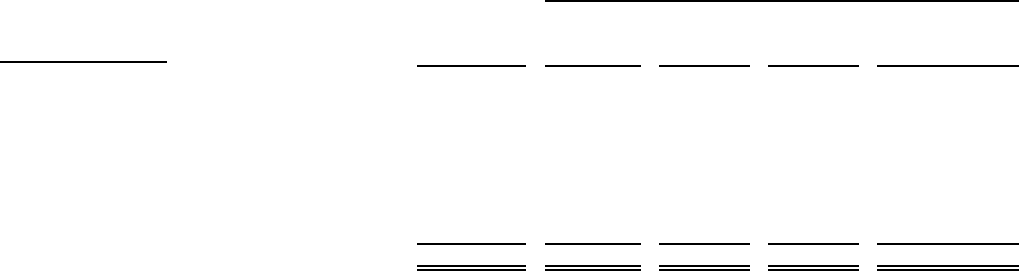

isclosures about Contractual Obligations and Commercial Commitments

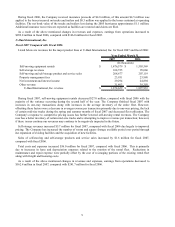

The following table provides contractual commitments and contingencies as of March 31, 2007:

Contractual Obligations Total

Prior to

03/31/08

04/01/08

03/31/10

04/01/10

03/31/12

April 1, 2012

and Thereafter

Notes and loans payable - Principal $ 1,181,165 $ 92,335 $ 146,477 $ 118,175 $ 824,178

Notes and loans payable - Interest 473,513 71,259 125,812 110,624 165,818

Revolving credit agreement - Principal - - - - -

Revolving credit agreement - Interest - - - - -

AMERCO's operating leases 413,199 108,614 170,701 97,080 36,804

SAC Holding II Corporation notes and loans* 149,975 1,440 3,282 3,833 141,420

Elimination of SAC Holding II obligations to AMERCO (75,088) - - - (75,088)

Total contractual obligations $ 2,142,764 $ 273,648 $ 446,272 $ 329,712 $ 1,093,132

Payment due by Period (as of March 31, 2007)

(In thousands)

As presented above, contractual obligations on debt and guarantees represent principal payme

nts while contractual

* loans represent obligations of SAC Holding II issued to third party lenders and AMERCO through

its subsidiaries.

obligations for operating leases represent the notional payments under the lease arrangements.

These notes and