U-Haul 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

Note 14: Employee Benefit Plans

Profit Sharing Plans

The Company provides tax-qualified profit sharing retirement plans for the benefit of eligible employees, former

employees and retirees in the U.S. and Canada. The plans are designed to provide employees with an accumulation of funds

for retirement on a tax-deferred basis and provide for annual discretionary employer contributions. Amounts to be

contributed are determined by the Chief Executive Officer (“CEO”) of the Company under the delegation of authority from

the Board, pursuant to the terms of the Profit Sharing Plan. No contributions were made to the profit sharing plan during

fiscal 2007, 2006 or 2005.

The Company also provides an employee savings plan which allows participants to defer income under Section 401(k)

of the Internal Revenue Code of 1986.

ESOP Plan

The Company sponsors a leveraged employee stock ownership plan (“ESOP”) that generally covers all employees with

one year or more of service. The ESOP shares initially were pledged as collateral for its debt which was originally funded

by U-Haul. As the debt is repaid, shares are released from collateral and allocated to active employees, based on the

proportion of debt service paid in the year. When shares are scheduled to be released from collateral, prorated over the year,

the Company reports compensation expense equal to the current market price of the shares scheduled to be released, and the

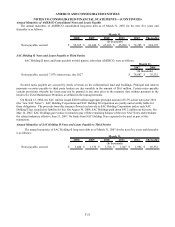

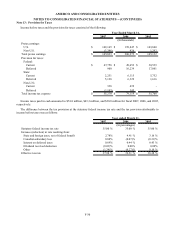

shares become outstanding for earnings per share computations. ESOP compensation expense was $4.7 million and $3.3

million for fiscal 2007 and 2006, respectively. Listed below is a summary of these financing arrangements as of fiscal year-

end:

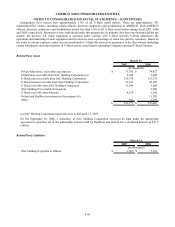

Financing Date

Outstanding as

of March 31,

2007 2007 2006 2005

June, 1991 $ 10,433 $ 694 $ 1,070 $ 1,008

March, 1999 60 5 9 8

February, 2000 419 31 53 54

April, 2001 117 6 10 9

Interest Payments

(In thousands)

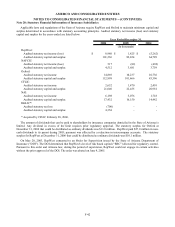

Shares are released from collateral and allocated to active employees based on the proportion of debt service paid in the

plan year. Contributions to the Plan Trust (“ESOT”) during fiscal 2007, 2006 and 2005 were $2.0 million, $2.3 million and

$2.1 million, respectively.

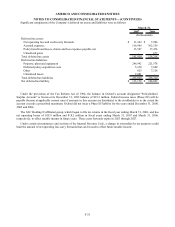

Shares held by the Plan were as follows:

2007 2006

Allocated shares 1,416 1,474

Unreleased shares 494 569

Fair value of unreleased shares $ 26,288 $ 41,726

Year Ended March 31,

(In thousands)

For purposes of the above schedule, the fair value of unreleased shares issued prior to 1992 is defined as the historical

cost of such shares. The fair value of unreleased shares issued subsequent to December 31, 1992 is defined as the trading

value of such shares as of March 31, 2007 and March 31, 2006, respectively.

F-32