U-Haul 2007 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2007 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

F

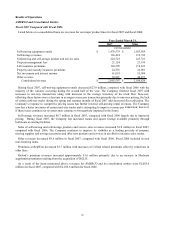

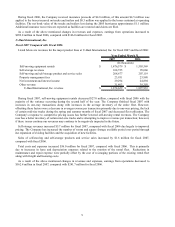

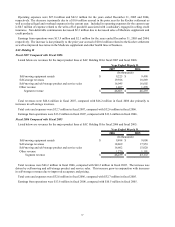

enues for the major product lines at our Moving and Storage Operating Segment for fiscal

2

Moving and Storage

iscal 2007 Compared with Fiscal 2006

Listed below are rev

007 and fiscal 2006:

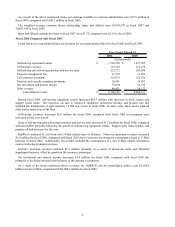

2007 2006

Self-moving equipment rentals $ 1,476,579 $ 1,503,569

Self-storage revenues 106,498 100,873

Self-moving and self-storage product and service sales 208,677 207,119

Property management fees 23,951 23,988

Net investment and interest income 34,161 30,025

Other revenue 25,994 34,894

Moving and Storage revenue $ 1,875,860 $ 1,900,468

(In thousands)

Year Ended March 31,

transaction; however,

if

ootage available period over period through

th

terest income increased $4.1 million primarily due to increases in interest

o

torage represent Company-owned locations only. Self-storage data for our

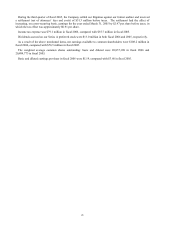

During fiscal 2007, self-moving equipment rentals decreased $27.0 million, compared with fiscal 2006 with the

majority of the variance occurring during the second half of the year. The Company finished fiscal 2007 with

increases in one-way transactions along with increases in the average inventory of the entire fleet. However,

offsetting these factors were a decrease in average revenue per transaction primarily due to one-way pricing, the lack

of certain mid-size trucks during the spring and summer months of fiscal 2007 and decreased fleet utilization. The

Company’ s response to competitive pricing issues has further lowered self-moving rental revenues. The Company

now has a better inventory of certain mid-size trucks and is attempting to improve revenue per

these issues continue our revenues may continue to be negatively impacted in the future.

Self-storage revenues increased $5.6 million for fiscal 2007, compared with fiscal 2006 primarily due to improved

pricing. The Company has increased the number of rooms and square f

e expansion of existing facilities and the acquisition of new facilities.

Other revenues decreased $8.9 million for fiscal 2007, compared with fiscal 2006. Fiscal 2006 included several

non-recurring items. Net investment and in

n invested cash and higher interest rates.

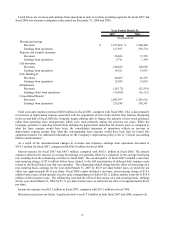

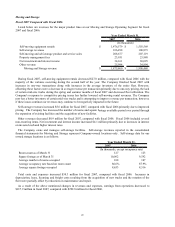

The Company owns and manages self-storage facilities. Self-storage revenues reported in the consolidated

financial statements for Moving and S

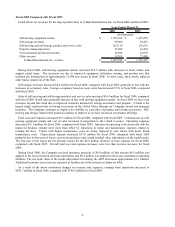

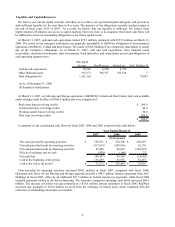

owned storage locations is as follows:

2007 2006

Room count as of March 31 127 123

Square footage as of March 31 10,062 9,592

Average number of rooms occupied 108 107

Average occupancy rate based on room count 86.6% 87.9%

Average square footage occupied 8,653 8,516

Year Ended March 31,

(In thousands, except occupancy rate)

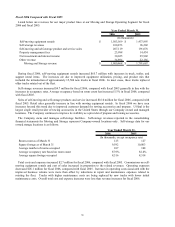

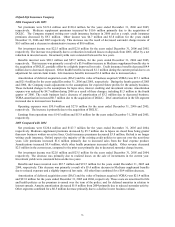

Total costs and expenses increased $50.3 million for fiscal 2007, compared with fiscal 2006. Increases in

depreciation, lease, licensing and freight costs resulting from the acquisition of new trucks and the rotation of the

fl

earnings from operations decreased to

$217.9 million in fiscal 2007, compared with $292.8 million for fiscal 2006.

eet were partially offset by reductions in maintenance and repair.

As a result of the above mentioned changes in revenues and expenses,