U-Haul 2007 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2007 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

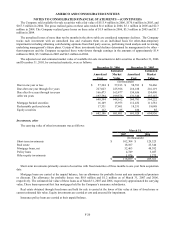

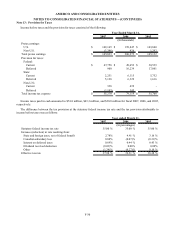

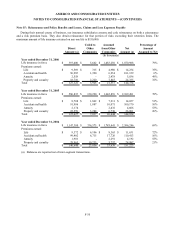

Note 13: Provision for Taxes

Income before taxes and the provision for taxes consisted of the following:

2007 2006 2005

Pretax earnings:

U.S. $ 149,169 $ 199,847 $ 143,840

Non-U.S. (3,346) 426 1,292

Total pretax earnings $ 145,823 $ 200,273 $ 145,132

Provision for taxes:

Federal:

Current $ 47,758 $ 49,652 $ 30,539

Deferred 900 16,239 17,801

State:

Current 2,251 6,115 5,752

Deferred 5,128 6,329 1,616

Non-U.S.:

Current 338 439 -

Deferred (1,105) 345 -

Total income tax expense $ 55,270 $ 79,119 $ 55,708

Year Ended March 31,

(In thousands)

Income taxes paid in cash amounted to $74.8 million, $43.3 million, and $30.0 million for fiscal 2007, 2006, and 2005,

respectively.

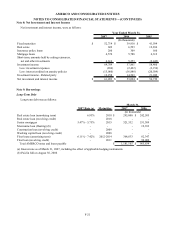

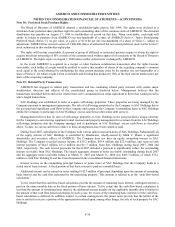

The difference between the tax provision at the statutory federal income tax rate and the tax provision attributable to

income before taxes was as follows:

2007 2006 2005

Statutory federal income tax rate 35.00 % 35.00 % 35.00 %

Increase (reduction) in rate resulting from:

State and foreign taxes, net of federal benefit 2.78% 4.41 % 3.16 %

Canadian subsidiary loss 0.80% (0.07)% (0.31)%

Interest on deferred taxes 0.69% 0.44 % 0.43 %

Dividend received deduction (0.03)% 0.00% 0.00%

Other (1.34)% (0.27)% 0.10 %

Effective tax rate 37.90 % 39.51 % 38.38 %

Year ended March 31,

(In percentages)

F-30