U-Haul 2007 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2007 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

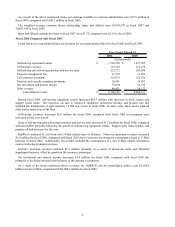

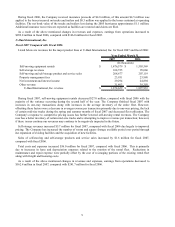

As a result of the above mentioned items, net earnings

26

available to common shareholders were $77.6 million in

fi

common shares outstanding: basic and diluted were 20,838,570 in fiscal 2007 and

20

iscal 2007 were $3.72, compared with $5.19 in fiscal 2006.

F

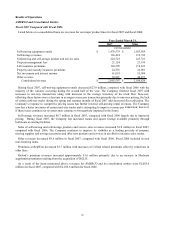

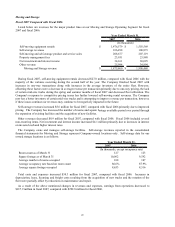

isted below on a consolidated basis are revenues for our major product lines for fiscal 2006 and fiscal 2005:

scal 2007, compared with $108.2 million in fiscal 2006.

The weighted average

,857,108 in fiscal 2006.

Basic and diluted earnings per share in f

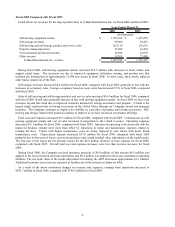

iscal 2006 Compared with Fiscal 2005

L

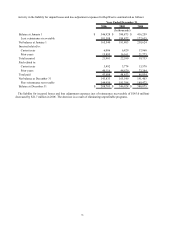

2006 2005

Self-moving equipment rentals $ 1,503,569 $ 1,437,895

Self-storage revenues 119,742 114,155

Self-moving and self-storage product and service sales 223,721 206,098

Property management fees 21,195 11,839

Life insurance premiums 118,833 126,236

Property and casualty insurance premiums 26,001 24,987

Net investment and interest income 53,094 56,739

Other revenue 40,471 30,172

Consolidated revenue $ 2,106,626 $ 2,008,121

(In thousands)

Year Ended March 31,

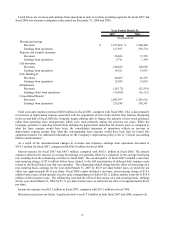

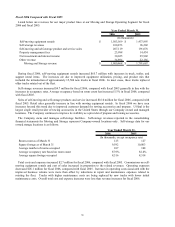

During fiscal 2006, self-moving equipment rentals increased $65.7 million with increases in truck, trailer, and

support rental items. The increases are due to improved equipment utilization, pricing, and product mix that

included the introduction of approximately 15,500 new trucks in fiscal 2006. In most cases, these trucks replaced

ol

sed $5.6 million for fiscal 2006, compared with fiscal 2005 as occupancy rates

in

e growth in self-moving equipment rentals. Support sales items, hitches, and

p

fiscal 2005 included the commutation of a non U-Haul related reinsurance

co

as a result of decreased credit and Medicare

su

l 2006, compared with fiscal 2005 due

p

nd its consolidated entities were $2,106.6

million for fiscal 2006, compared with $2,008.1 million for fiscal 2005.

der trucks rotated out of the fleet.

Self-storage revenues increa

creased period over period.

Sales of self-moving and self-storage products and service sales increased $17.6 million for fiscal 2006, compared

with fiscal 2005 generally following th

ropane all had increases for the year.

RepWest continued to exit from non U-Haul related lines of business. However, premium revenues increased

$1.0 million for fiscal 2006, compared with fiscal 2005 due to increases in retrospective premiums related to U-Haul

business in fiscal 2006. Additionally,

ntract reducing premium revenues.

Oxford’ s premium revenues declined $7.4 million primarily

pplement business, offset by growth in life insurance premiums.

Net investment and interest income decreased $3.6 million for fisca

rimarily to declining invested asset balances at the insurance companies.

As a result of the items mentioned above, revenues for AMERCO a