U-Haul 2007 Annual Report Download - page 129

Download and view the complete annual report

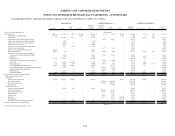

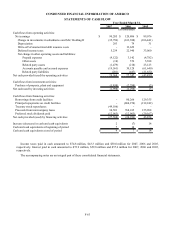

Please find page 129 of the 2007 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CONDENSED FINANCIAL INFORMATION OF AMERCO

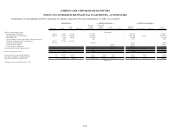

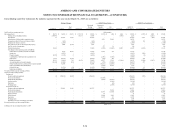

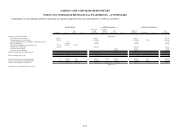

NOTES TO CONDENSED FINANCIAL INFORMATION

MARCH 31, 2007, 2006, AND 2005

1. Summary of Significant Accounting Policies

AMERCO, a Nevada corporation, was incorporated in April, 1969, and is the holding Company for

U-Haul International, Inc., Amerco Real Estate Company, Republic Western Insurance Company and Oxford Life

Insurance Company. The financial statements of the Registrant should be read in conjunction with the Consolidated

Financial Statements and notes thereto included in this Form 10-K.

AMERCO is included in a consolidated Federal income tax return with all of its U.S. subsidiaries excluding Dallas

General Life Insurance Company, a subsidiary of Oxford. Accordingly, the provision for income taxes has been calculated

for Federal income taxes of AMERCO and subsidiaries included in the consolidated return of the Registrant. State taxes for

all subsidiaries are allocated to the respective subsidiaries.

The financial statements include only the accounts of AMERCO, which include certain of the corporate operations of

AMERCO (excluding SAC Holding II). The interest in AMERCO’ s majority owned subsidiaries is accounted for on the

equity method. The intercompany interest income and expenses are eliminated in the consolidated financial statements.

2. Guarantees

AMERCO has guaranteed performance of certain long-term leases and other obligations. See Note 16 “Contingent

Liabilities and Commitments” and Note 19 “Related Party Transactions” of the “Notes to Consolidated Financial

Statements”.

F-64