U-Haul 2007 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2007 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

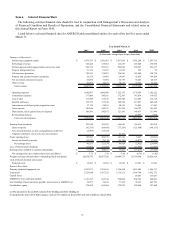

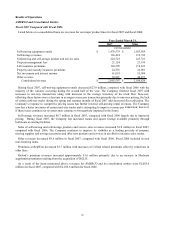

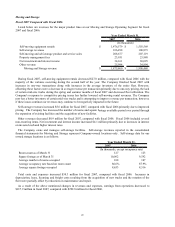

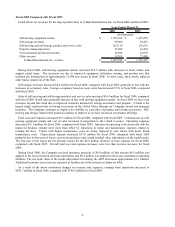

Listed below are revenues and earnings from operations at each of our four operati

25

ng segments for fiscal 2007 and

fiscal 2006, the insurance companies years ended are December 31, 2006 and 2005.

Earnings from operations 235,548 305,381

2007 2006

Moving and storage

Revenues $ 1,875,860 $ 1,900,468

Earnings from operations 217,937 292,774

Property and casualty insurance

Revenues 38,486 37,358

Earnings from operations 5,741 1,144

Life insurance

Revenues 148,820 148,080

Earnings from operations 14,521 13,933

SAC Holding II

Revenues 46,603 46,239

Earnings from operations 13,854 13,643

Eliminations

Revenues (24,172) (25,519)

Earnings (loss) from operations (16,505) (16,113)

Consolidated Results

Revenues 2,085,597 2,106,626

(In thousands)

Year Ended March 31,

dditional information on the Company’ s depreciation policy refer to “Critical Accounting

P

rnings from operations decreased to

$

ended March 31, 2006 by $1.71 per share before taxes, in which the tax effect was approximately $0.63

p

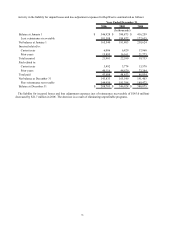

Dividends accrued on our Series A preferred stock were $13.0 million in both fiscal 2007 and 2006, respectively.

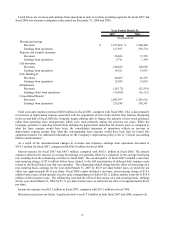

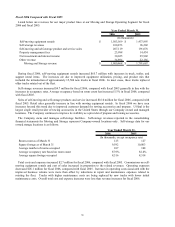

Total costs and expenses increased $48.8 million in fiscal 2007, compared with fiscal 2006. This is due primarily

to increases in depreciation expense associated with the acquisition of new trucks and the fleet rotation. Beginning

in the second half of fiscal 2006 the Company began utilizing debt to finance the majority of new truck purchases

rather than operating lease arrangements which were used primarily during the previous ten years. While the

Company generates a cash flow benefit from utilizing the depreciation deduction for income taxes as compared to

what the lease expense would have been, the consolidated statement of operations reflects an increase in

depreciation expense greater than what the corresponding lease expense would have been had we leased this

equipment instead. For a

olicies and Estimates”.

As a result of the aforementioned changes in revenues and expenses, ea

235.5 million for fiscal 2007, compared with $305.4 million for fiscal 2006.

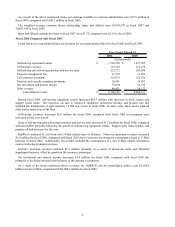

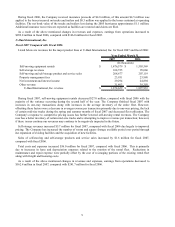

Interest expense for fiscal 2007 was $89.7 million, compared with $105.1 million in fiscal 2006. The interest

expense related to the increase in average borrowings was partially offset by a reduction in the average borrowing

rate resulting from the refinancing activities in fiscal 2006. The second quarter of fiscal 2007 included a one-time,

non-recurring charge of $7.0 million before taxes related to the full amortization of deferred debt issuance costs

related to the Real Estate Loan that was amended. The refinancing related charge had the effect of decreasing on a

non-recurring basis, earnings for the year ended March 31, 2007 by $0.33 per share before taxes, in which the tax

effect was approximately $0.13 per share. Fiscal 2006 results included a one-time, non-recurring charge of $35.6

million before taxes which includes fees for early extinguishment of debt of $21.2 million and the write-off of $14.4

million of debt issuance costs. The refinancing costs had the effect of decreasing, on a non-recurring basis, earnings

for the year

er share.

Income tax expense was $55.3 million in fiscal 2007, compared with $79.1 million in fiscal 2006.