U-Haul 2007 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2007 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

Note 17: Contingencies

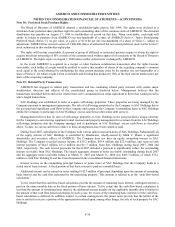

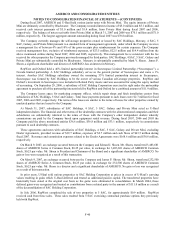

Shoen

On September 24, 2002, Paul F. Shoen filed a derivative action in the Second Judicial District Court of the State of

Nevada, Washoe County, captioned Paul F. Shoen vs. SAC Holding Corporation et al., CV02-05602, seeking damages and

equitable relief on behalf of AMERCO from SAC Holdings and certain current and former members of the AMERCO

Board of Directors, including Edward J. Shoen, Mark V. Shoen and James P. Shoen as defendants. AMERCO is named a

nominal defendant for purposes of the derivative action. The complaint alleges breach of fiduciary duty, self-dealing,

usurpation of corporate opportunities, wrongful interference with prospective economic advantage and unjust enrichment

and seeks the unwinding of sales of self-storage properties by subsidiaries of AMERCO to SAC Holdings prior to the filing

of the complaint. The complaint seeks a declaration that such transfers are void as well as unspecified damages. On October

28, 2002, AMERCO, the Shoen directors, the non-Shoen directors and SAC Holdings filed Motions to Dismiss the

complaint. In addition, on October 28, 2002, Ron Belec filed a derivative action in the Second Judicial District Court of the

State of Nevada, Washoe County, captioned Ron Belec vs. William E. Carty, et al., CV 02-06331 and on January 16, 2003,

M.S. Management Company, Inc. filed a derivative action in the Second Judicial District Court of the State of Nevada,

Washoe County, captioned M.S. Management Company, Inc. vs. William E. Carty, et al., CV 03-00386. Two additional

derivative suits were also filed against these parties. These additional suits are substantially similar to the Paul F. Shoen

derivative action. The five suits assert virtually identical claims. In fact, three of the five plaintiffs are parties who are

working closely together and chose to file the same claims multiple times. These lawsuits alleged that the AMERCO Board

lacked independence. In reaching its decision to dismiss these claims, the court determined that the AMERCO Board of

Directors had the requisite level of independence required in order to have these claims resolved by the Board. The court

consolidated all five complaints before dismissing them on May 28, 2003. Plaintiffs appealed and, on July 13, 2006, the

Nevada Supreme Court reviewed and remanded the claim to the trial court for proceedings consistent with its ruling,

allowing the plaintiffs to file an amended complaint and plead in addition to substantive claims, demand futility. On

November 8, 2006, the nominal plaintiffs filed an Amended Complaint. On December 22, 2006, the defendants filed

Motions to Dismiss. Briefing was concluded on February 21, 2007. On March 30, 2007, the Court heard oral argument on

Defendants’ Motions to Dismiss and requested supplemental briefing. The supplemental briefs were filed on May 14, 2007.

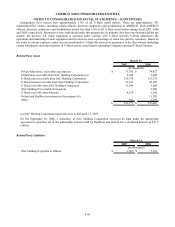

Environmental

In the normal course of business, AMERCO is a defendant in a number of suits and claims. AMERCO is also a party to

several administrative proceedings arising from state and local provisions that regulate the removal and/or cleanup of

underground fuel storage tanks. It is the opinion of management, that none of these suits, claims or proceedings involving

AMERCO, individually or in the aggregate, are expected to result in a material loss.

Compliance with environmental requirements of federal, state and local governments significantly affects Real Estate’ s

business operations. Among other things, these requirements regulate the discharge of materials into the water, air and land

and govern the use and disposal of hazardous substances. Real Estate is aware of issues regarding hazardous substances on

some of its properties. Real Estate regularly makes capital and operating expenditures to stay in compliance with

environmental laws and has put in place a remedial plan at each site where it believes such a plan is necessary. Since 1988,

Real Estate has managed a testing and removal program for underground storage tanks.

Based upon the information currently available to Real Estate, compliance with the environmental laws and its share of

the costs of investigation and cleanup of known hazardous waste sites are not expected to have a material adverse effect on

AMERCO’ s financial position or operating results. Real Estate expects to spend approximately $7.6 million in total through

2011 to remediate these properties.

Other

The Company is named as a defendant in various other litigation and claims arising out of the normal course of

business. In management’ s opinion none of these other matters will have a material effect on the Company’ s financial

position and results of operations.

F-38