U-Haul 2007 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2007 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

Q

r). The operating results for the periods presented are not necessarily

in cative of results for any future period.

Basic and diluted $ (0.89) $ (0.61) $ 2.73 $ 2.49

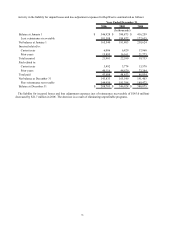

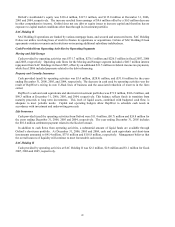

Quarter Ended

(In thousands, except for share and per share data)

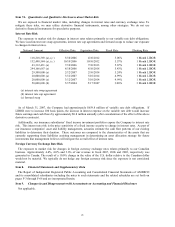

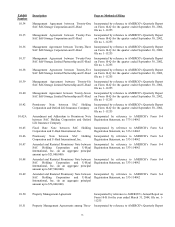

uarterly Results (unaudited)

The quarterly results shown below are derived from unaudited financial statements for the eight quarters

beginning April 1, 2005 and ending March 31, 2007. The Company believes that all necessary adjustments have

been included in the amounts stated below to present fairly, and in accordance with generally accepted accounting

principles, such results. Moving and Storage operations are seasonal and proportionally more of the Company’ s

revenues and net earnings from its Moving and Storage operations are generated in the first and second quarters of

each fiscal year (April through Septembe

di

March 31,

2007

December 31,

2006 (a)

September 30,

2006 (a), (b)

June 30,

2006 (a)

Total revenues $ 445,197 $ 466,838 $ 606,535 $ 567,027

Earnings (loss) from operations (8,774) 8,146 126,133 110,043

Net earnings (loss) (15,660) (9,551) 60,418 55,346

Earnings (loss) available to common

shareholders (18,900) (12,792) 57,177 52,105

Weighted average common shares

outstanding: basic and diluted 20,682,087 20,922,433 20,910,204 20,897,688

Earnings (loss) per common share

(a) The retroactive adoption of SAB 108 had the effect of decreasing operating and net earnings from amounts

previously reported by $0.1 million for each of the first three quarters of fiscal 2007. The Company determined that

the adjustment would not be material in any specific period and therefore did not restate historical financial

007 included a non-recurring amortization of $7.0 million, pre-tax on deferred

Basic and diluted $ (0.07) $ 0.57 $ 3.16 $ 1.53

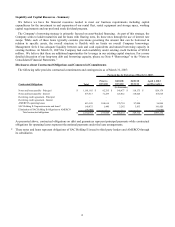

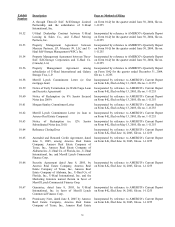

Quarter Ended

(In thousands, except for share and per share data)

statements. See discussion under “Adoption of New Accounting Pronouncements”.

(b) The second quarter fiscal 2

charges related to a refinancing.

March 31,

2006

December 31,

2005

September 30,

2005

June 30,

2005 (c)

Total revenues $ 445,982 $ 495,670 $ 605,516 $ 559,458

Earnings from operations 19,164 45,419 128,238 112,560

Net earnings 1,800 15,170 69,122 35,062

Earnings (loss) available to common

shareholders (1,440) 11,929 65,881 31,821

Weighted average common shares

outstanding: basic and diluted 20,887,258 20,865,684 20,848,620 20,836,458

Earnings (loss) per common share

urring fee of $21.2 million on early extinguishment of

debt and a write-off of $14.4 million of debt issuance costs.

(c) The first quarter fiscal 2006 results included a non-rec