U-Haul 2007 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2007 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

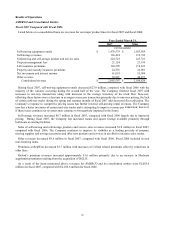

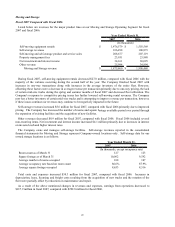

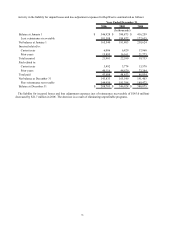

Listed below are revenues and earnings (loss) from operations at each of our four operating s

27

egments for fiscal

006 and fiscal 2005; for the insurance companies years ended are December 31, 2005 and 2004:

2

2006 2005

Moving and storage

Revenues $ 1,900,468 $ 1,791,667

Earnings from operations 292,774 165,985

Property and casualty insurance

Revenues 37,358 41,417

Earnings (loss) from operations 1,144 (14,814)

Life insurance

Revenues 148,080 159,484

Earnings from operations 13,933 2,065

SAC Holding II

Revenues 46,239 43,172

Earnings from operations 13,643 10,466

Eliminations

Revenues (25,519) (27,619)

Earnings (loss) from operations (16,113) 3,294

Consolidated Results

Revenues 2,106,626 2,008,121

Earnings from operations 305,381 166,996

Year Ended March 31,

(In thousands)

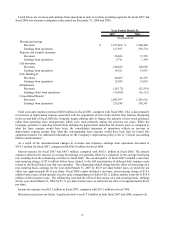

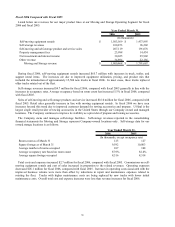

Total costs and expenses decreased $39.9 million for fiscal 2006, compared with fiscal 2005. Total costs and

expenses for both insurance companies decreased $43.3 million due primarily to reductions in benefits and losses.

Fiscal 2005 included a $10.6 million charge for litigation at Oxford not present in fiscal 2006. Increases in

operating costs associated with the improved business volume at Moving and Storage were offset by reductions in

repair and maintenance expenses related to rotating the fleet. Trucks with higher maintenance costs are being

re

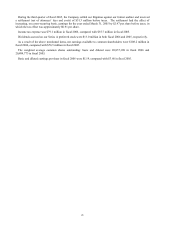

of catastrophic events. Our insurance deductible is $500,000 and was recorded in our

se

imates $1.1 million.

A

ngs from operations improved to $305.4

m

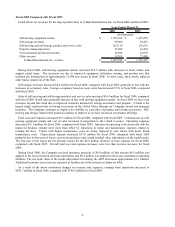

ended March 31, 2006 by $1.71 per share before taxes, in which the tax effect

was approximately $0.63 per share.

placed by new trucks with lower initial maintenance costs.

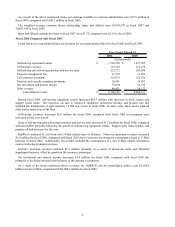

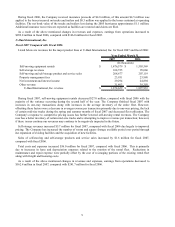

In our second quarter of fiscal 2006, hurricanes Katrina and Rita struck the Gulf Coast of the United States

causing business interruption to a number of our operating facilities. We identified customers impacted by the

hurricanes and our rapid response teams provided a variety of solutions to divert operations to alternate facilities and

restore operations where possible. We lost approximately 150 trucks and 150 trailers during and after the devastation

caused by these hurricanes. We maintain property and business interruption insurance coverage to mitigate the

financial impact of these types

cond quarter of fiscal 2006.

During fiscal 2006, the Company received insurance proceeds of $4.8 million, of this amount $4.5 million was

applied to the losses incurred on trucks and trailers and $0.3 million was applied to the losses sustained at operating

facilities. The net book value of the trucks and trailers lost during the 2005 hurricanes approx

dditional insurance recoveries are expected as facilities are fully restored and claims are filed.

As a result of the aforementioned changes in revenues and expenses, earni

illion for fiscal 2006, compared with $167.0 million for fiscal 2005.

Interest expense for fiscal 2006 was $105.1 million, compared with $73.2 million in fiscal 2005. Fiscal 2006

results included a one-time, non-recurring charge of $35.6 million before taxes which includes fees for early

extinguishment of debt of $21.2 million and the write-off of $14.4 million of debt issuance costs. The expense

related to the increase in average borrowings was partially offset by a reduction in the average borrowing rate

resulting from the refinancing activities in fiscal 2006. The refinancing costs had the effect of decreasing, on a non-

recurring basis, earnings for the year